Having barely survived the first wave, faced cancellations and supply chain disruptions, now struggling to continue under the impact of the second wave and mentally ready for the third wave… moving along with Covid is now part of the apparel and textile business. Moving beyond to ‘New Normal’, Zoom meetings, digital showrooms, adopting to needs of social distancing and vaccination, coping with unpredictability are some of the important changes that have come along with Covid. Although the Indian textile and apparel industry faced a loss of around US $ 31 billion owing to the pandemic, but at the same time, it learnt a few important lessons also.

Apparel Resources presents a White Paper on how Covid impacted Indian apparel industry in every aspect, what has changed and what can be the future of Indian textile and apparel industry.

Total estimated loss

As per the industry estimates and backed by data, Covid resulted in a total loss of at least US $ 31 billion to the Indian textile and apparel industry.

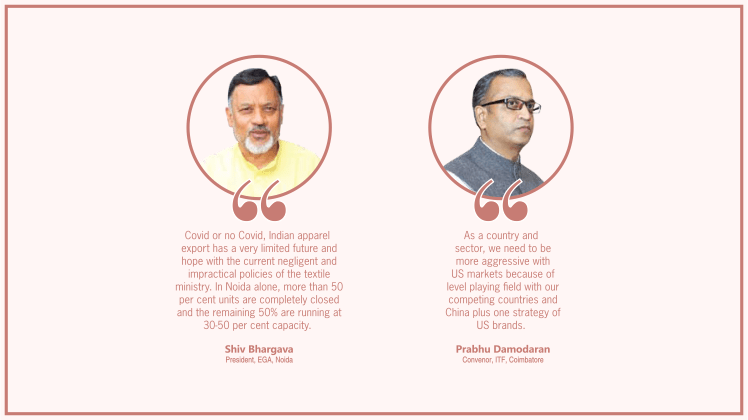

As far as India’s apparel export is concerned, according to official data during FY 2019-20 and FY 2020-21, it was worth US $ 15.5 billion and US $ 12.3 billion, respectively. This means that for the financial year 2020-21, there has been a loss of at least US $ 3.2 billion.

On the domestic front, CMAI’s survey of the domestic market estimated the size of the overall market to be Rs.7.25 lakh crore. It believes 2020-21 saw a drop of close to 20 per cent in consumption which is Rs.1.5 lakh crore. Whilst it is too early to estimate the drop in consumption in 2021-22, CMAI believes that there will be at least another 10 per cent drop. It means domestic market will have a total loss of US $ 28 billion.

As far as individual level is concerned, many companies shared that on an average, there has been a decline of 40 per cent in top line and 60 per cent in profitability.

Time to time in last 15 months, there were various media reports particularly from hubs facing huge losses like Noida having a loss of Rs. 9,000 crore (US $ 1.28 billion), Tirupur staring at a loss of Rs. 10,000 crore to Rs. 12,000 crore (US $ 1.42 billion to US $ 1.71 billion), Surat textiles industry losses amounting to Rs. 6,000 crore (US $ 0.85 billion), etc.

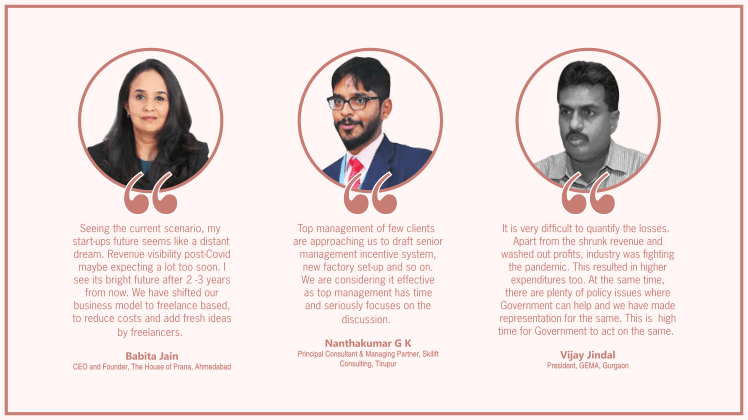

Few industry experts are of the opinion that it is little early to reach a conclusion on loss but at the same time they agree that there is at least a loss of US $ 31 billion. Adding to the same, some brand closures overseas may never revive, thus their suppliers will be affected permanently. Many exporters have been severely impacted by overseas bankruptcies resulting in total losses even of the exported merchandise. Most of the exports did not have ECGS coverage.

Series of challenges

There were a series of continuous challenges for Indian apparel industry, initially during February 2020 when they started suffering from first wave of Covid. Factories were totally closed for around 2 months. It was expected that domestic market will pick up near festival and marriage season but it was not as per industry expectation.

After that there was the burning issue of high cost raw material across India and it continued for almost 6 months, and was finally solved when Ministry of Textiles intervened.

The overall operations started picking up but then the second wave attacked. Labour shortage and working allowed with very less workforce also added to their worries. And even in mid-June 2021, these were serious challenges. As per Retailers’ Association of India (RAI), pan-India overall retail sales in April 2021 were down by 49 per cent versus pre-Covid levels.

On the export front, top brands and retailers like GAP and William Sonama have reacted on these challenges in India. “We’re watching the evolving pressures on our supply chain from both Covid outbreaks in India and Southeast Asia, as well as the ongoing raw material supply pressures,” said Sonia Syngal, CEO, Gap during the Q1 of 2021 results’ earnings call.

If industry insiders are to be believed, in June, many companies air-shipped their ready goods as work delayed due to above mentioned challenges.

Closure of factories leading to huge job loss

Covid and allied challenges led to closure of many units, not only of MSMEs, but also top players which have huge capacities and operations in many states. Many apparel manufacturers did not ‘close’ their units but ‘restructured’. Few of the companies which were doing both segments (knit and woven), shifted their woven capacity to knits. Complete lockdown (during first wave) and permanent closure of many factories and shifting of migratory workers to their home town turned into huge job loss.

In May 2021, State Government of Karnataka officially told that more than one lakh women lost jobs due to Covid in Bengaluru. In various surveys conducted by CMAI during first and second waves, huge job loss was predicted.

In Surat only, an internal survey carried out by the Federation of Surat Textile Traders’ Association (FOSTTA) and the textile committee of The Southern Gujarat Chamber Of Commerce and Industry (SGCCI) revealed that nearly one lakh workers have been laid off in just two months of 2020.

It is also pertinent to mention here that not only workers lost their jobs, even mid-level professionals faced heavy job loss. In an extensive report, apparelresources.com has analysed that 2 lakh mid-level professionals are facing job loss. H&M India sourcing office also laid off around 60 people.

There is still no survey or report about how many workers and mid-level professionals will get new jobs again.

Leading companies closed factories

- Gokaldas Exports (Mandya, Mysore)

- Orient Craft (Noida and Ranchi)

- Shahi Exports (Chhindwara, MP)

- Arvind Ltd. (Ahmedabad)

- Thriveni Apparels and Textiles (Jharkhand)

Expansion plans on hold/cancelled

- Cotton Blossom at Ranchi

Expansions continue, new projects coming up

At the same time it is also pertinent to mention here that irrespective of all challenges, a chunk of the industry is continuously growing and expanding. Deep pockets, expectation of good business in future and strong fundamentals are some of the reasons that these companies announced their expansion plans in unprecedented times. Few of them even executed their plans in this ever challenging scenario.

October 2020: KPR Mills announced to start a new garment factory with an investment of Rs. 250 crore. It also announced to hire 12,000 workers from Jharkhand.

November 2020: Ashwathy Garments, Ranchi (quite a new organisation as well as new factory)

January 2021: Chhattisgarh got its first-ever organised factory Nva Dantewada garment factory, Dantewada

January 2021: MGM Minerals Ltd., Odisha announced to set up a garment factory; job opportunity for 1,000 women

April 2021: Gokaldas Images signed an MoU to start a garment factory in Telangana; will offer jobs to 1,100 people

April 2021: It was confirmed by Youngone Corporation to start operations in Warangal soon (project was announced in Dec.2019)

In UP and Bihar, many small projects were started and workers who came back from various apparel manufacturing hubs are running these projects by making garments for local markets.

Public ltd. companies: profit reduced for many

Across the supply chain and regions, medium-size or giants, many public limited companies were in profit in FY ’21. Though the profit was under pressure for many, but at the same time, few companies had good growth. There were companies like KPR Mills having more than double consolidated profit after tax (PAT) for Mar ’21 quarter. Pure apparel exporting companies like Gokaldas Exports had good results. Innerwear brands of Kolkata also had enthusiastic results. Lux Industries crossed US $ 1 billion market capitalisation. And this was due to the major apparel consuming markets starting to return to normalcy, resulting in a healthy order book.

Unethical practices

Willingly or forcibly, Covid highlighted the unethical practices being carried out in the industry and that too across the supply chain and globe. Many buyers not only cancelled orders, delayed payments but also insisted on illogical discounts. At the same time, apparel exporters deducted salary of their employees. Textile companies and traders blamed yarn price manipulation. Most of the mid-level professionals faced salary issues.

Though there were few good things or exceptions also like in October 2020, C&A fully compensated apparel suppliers for all pre-Covid orders. Shahi Exports made refund of whatever deduction were made to its employees. Similarly, Asmara announced refund of salary deducted during pandemic. Later few more companies took such steps. Some of the top level officials of companies also came forward and said that they will not take salary of two to three months (when companies were closed due to lockdown or partially worked).

Helping hand

Be it first wave or second, industry across regions also supported its staff, society and Government at collective as well as individual level. Donations, arrangement of Covid care centres, distribution of food, oxygen concentrators were few of the focus areas for the industry. Efforts of Tirupur Exporters Forum (TEF) and Dyers Association of Tirupur (DAT), Noida Apparel Export Cluster (NAEC) Vardhman Group, Aditya Birla, Pratibha Syntex, Jack and many more are really commendable in this regard.

Changes/learnings post-Covid

There were many changes noticed in the industry and from small to large companies. Each of them tried to adopt these changes as per their scale, requirement, knowhow, capacity and vision. Automation, digitisation, rationalisation and the product diversification to become more competitive were some of the major changes adopted by many companies.

Strategy level

Now companies are doing short-term planning and adopting higher flexibility in accepting orders and execution. They are effectively developing management structure across all the levels. Quick thinking and constant adoption has helped them become more agile and dynamic.

Product specific

In domestic market, athleisure was a big win amongst shoppers as lockdowns drove demand. For example, leading apparel giant, Aditya Birla Fashion and Retail (ABFRL)’s active athleisure and innerwear segment grew 56 per cent in Q4 of FY ’21 over the same quarter last year. Selling innerwear and athleisure under the Jockey brand, Page Industries has also reported an uptick in demand in this same period.

Though for few months only, but Indian apparel exporters showed their resilience by adopting PPE revolution as despite being a totally new thing for them, they did a tremendous job in the domain of PPE manufacturing. Moving forward, some of the companies also added medical textiles in their product offering.

Home furnishing segment too performed well and is expecting good growth as Work-from-Home is going to sustain.

Overseas buyers in the affordable luxury industry, which run mostly online were relatively safer in these uncertain times.

Online boom

A drastic shift in online sales has been noticed, as people are skeptical to shop at bricks-and-mortar stores and e-commerce platforms can be accessed from the comfort of one’s home. The change in consumer behaviour has compelled brands across the globe to strengthen their e-commerce presence as it has huge potential.

Fashion E-commerce Report by Unicommerce says that in India, online fashion industry witnessed an order volume growth of 51 per cent and gross merchant value (GMV) increase of 45 per cent in FY ’21 as compared to the previous financial years of organisation.

In factories/offices

As an aftermath of Covid, business is shifting from people-centric approach to system-centric functioning, more and more use of technology and ERP. The manufacturing facilities are adopting as much digital platform as possible so that any disruption in factory working, information flow is maintained. 3D sampling and digital showrooms have been the most adopted technologies in last 15 months.

For example, Dollar Industries Ltd. upgraded its internal digital platforms to smoothen its operations and adopted digital distribution management system, salesforce automation system and auto replenishment system. The company, which introduced athleisurewear last year, is further planning to enter lingerie business this year and also to build up its kids’ range as both these segments have ample opportunities.

Multitasking, freelancing

Reasons like cost cutting, social distancing, work allowed with less workers etc., forced/motivated companies as well as professionals to increase multitasking culture. From shopfloor to merchandising, accounts to HR, compliance, everywhere this trend is prevailing. At the same time, freelance work has also increased especially in areas like compliance, pattern making.

Work from Home (WFH)

Apparel manufacturing industry hardly thought about WFH. But now professionals from various departments like merchants, production planning, purchase, accounts, HR and marketing are working from home. Maral Overseas, Noida bought 50 laptops for its staff so they can work from home comfortably. The companies are more liberal in this regard now.

Strong bonding of staff with companies

Many companies showed kind gesture during Covid and supported their employees in very good way. They communicated frequently and clearly with employees and did not deduct their salaries. Even if there was deduction, they were logical and staff was taken into confidence. The staff who suffered from Covid got extra monetary and psychological support from their organisations. Due to all such activities, staff and companies were able to develop strong bonding with each other.

Government support

Announcement of PLI scheme and MITRA were big and direct supports to the industry. Though by the time of writing this, both are just announcements and no fine print has come but it definitely will strengthen the industry sentiments. And in future it can be a game changer also.

Rs. 20 lakh crore stimulus package, new definition of MSME, moratorium period, subsidy regarding provident funds, widening of eligible beneficiaries under Resolution Framework 2.0 by enhancing the maximum aggregate exposure threshold from Rs. 25 crore to Rs. 50 crore for MSMEs, various developments regarding Emergency Credit Line Guarantee Scheme (ECLGS) special liquidity facility of Rs. 16,000 crore to Small Industries Development Bank of India (SIDBI) and some other steps were also taken by the Government to support overall economy.

UP and Bihar Government have come forward to support their experienced workers (those who used to work in apparel factories) by skill mapping and creating employment at local level.

But overall apparel industry is not much happy with all this and a big chunk of apparel manufacturers hardly got the real advantage of any scheme.

Rahul Mehta, CMAI says, “Obviously industry and consumers will always be disappointed with whatever the Government does, a feeling will always be there that it could have done more. However, I think given the resource crunch the Government is facing, it has done more or less the best it could have. Having said that, my belief is that businesses should have been supported more. Also, measures to put more money in the hands of the consumers would have helped the economy to revive faster, without needing further support from the Government.”

Industry bodies helped!

Various trade bodies organised several training programmes to educate members on multiple issues. AEPC launched a 24x7x365 virtual exhibition platform. Plenty of webinars, strong lobby with the Government were also made by trade bodies.

Moving ahead, future is full of hope

Even during mid-June, situation across India is not very enthusiastic be it in manufacturing or market front, factories operating with very less capacity, lesser orders, supply disruptions due to lockdowns etc. Animesh Saxena, MD, Neetee Clothing, Gurgaon who is also associated with few trade bodies is of the view that pandemic has taken industry back by 4-5 years. It will take time to recover and no expansions will be happening.

But at the same time, there is strong hope as a big chunk of industry believes in post-Covid boom in all major markets as it is said that after every pandemic or war, the economy rebounces very strongly.

Apparel exports are indeed on a recovery path with an exponential growth of 927 per cent in April, 2021 and 114 per cent in May, 2021 as compared to the same months of previous year.

As per CRISIL Research, India’s apparel industry is expected to grow by 15-20 per cent this financial year and it will be almost half the 28-33 per cent expected earlier. Apparel export expects 18-22 per cent growth in export demand in the year FY ’22, compared to a 16 per cent contraction in the previous year. On the other hand, domestic sales are growing 14-18 per cent this fiscal compared to a 24 per cent contraction last fiscal.

Things that will shape the future

- Vaccination

Mass vaccination going on in every Western country is resulting in opening of these markets and normalcy is being returned there. At the same time, India is also geared up for vaccination. Lot of factories across India are also vaccinating their workers and staff. As soon as vaccination take place, things will be normal.

- FTAs

In recent two months, there were some interesting developments made regarding Free Trade agreements (FTAs) like Commerce Secretary Anup Wadhawan said that India may begin formal negotiations for FTAs with the UK and EU by end of 2021 after completing ongoing preparatory work.

India and Australia’s official level discussions between both the countries, especially with regard to renewing talks on India Comprehensive Economic Cooperation Agreement (CECA), are also on as, reportedly, confirmed by Australia’s High Commissioner to India Barry O’ Farrell. Similarly India is also resuming FTA negotiations with Canada, taking forward negotiations with new countries including Peru and Israel and upgrading the existing preferential trade agreements with Chile and Mercosur.

Finally…

There are entrepreneurs and companies looking at the whole pandemic situation in a very positive manner. It has allowed them to test their stability and crisis management skills. All faced lots of short-term impacts on their business but at the same time they stayed optimistic, positive and together worked towards preparing their supply chain and diversifying their portfolio. Adopting change as per the requirement of time is the only mantra for survival and growth and our industry is also on the same track.