Intertek Group plc (‘Intertek’), a Total Quality Assurance provider to industries worldwide, recently hosted a virtual ‘Future of Fashion’ event, bringing together the fashion trade industry’s most influential commentators for the very first time to discuss major trends that are set to re-shape the fashion sector in a post-Covid-19 world, as part of a unique virtual collaboration.

Presented by Intertek’s Maison Centre of Excellence for Luxury ahead of its official opening in 2021, the event showcases the perspective of leading trends forecaster David Shah (Industry thought-leader and CEO at Metropolitan Publishing BV) as well as the editors of major textile supply chain publications.

The pandemic has accelerated a shift in attitudes, with consumers paying more attention than ever to the safety and quality and sustainability of materials used in fashion and accessories, and the risks associated with local and global supply chains.

André Lacroix, CEO Intertek, said: “With Covid-19 magnifying the focus on health, safety and well-being and ushering in different ways of working for everyone, all industries have been forced to adapt to changing consumer preferences and tastes, including the global premium and luxury fashion sector. With the premium and luxury fashion industry undergoing profound shifts at an even faster pace, the need for creative solutions underpinned by research, design and quality assurance expertise has never been more relevant.”

We need to accept that the pandemic and the damage caused by it has not necessarily changed the world, rather it has accelerated trends that were already shaping business. When it comes to deglobalisation, companies have been busy lowering their exposure to countries that carry high geopolitical or health risks for some time.

We have been talking about data for many years now and the period has only forced the industry to fast forward to adopting the same into its practices. Anything that promises to reduce stock and minimise risk has to be a plus.

The virus has also opened the door to a robotic army and the post-Coronavirus workforce could look quite different. Economic downturns have a habit of spurring automation.

The fashion sector is expected to contract by 27-30 per cent this year, according to the State of Fashion 2020 Coronavirus Update report by the Business of Fashion and McKinsey & Company.

David R Shah, Publisher and CEO at Metropolitan Publishing BV, said: “The pandemic has clearly accelerated trends that were emerging, and by 2022, we think the world will be much the same but, hopefully, with some significant changes. We will definitely care more about environmental policy and climate change; we will have to listen harder to the demands of the youth whose futures have been affected by the pandemic; and we will all have to learn to make do with less. The world of fashion will be playing a major part in all of this.”

An overview of the Fashion Industry’s resilience worldwide

Brands emerging from the Covid-19 situation will find inspiring new ways to approach seasonal collections, with a greater focus on capsule collections and in-season retail, as well as ever-greater collaboration and alliances amongst brands.

And while sustainability is here to stay, new styles and trends have emerged from lockdown as supply chains are upended, and the relentless acceleration towards digital collections and purchasing habits has entered a new phase, providing those in the industry with an opportunity to rethink the future of fashion.

The shift to more restrained, timeless pieces will ultimately give way to exuberance and excess – just as wartime fabric rationing paved the way for Dior’s New Look collection in 1947.

UK

The highly specialised, internationally focused UK woollen and worstedsbased textile industry has invested in new technology and data processing. Remotely conducted business with designer labels, couture houses and high-end tailors across the world has accelerated, proving unexpectedly successful for 2021 and beyond.

Retailers are contemplating novel ways to shift large amounts of unsold stock accumulated during the virus time, finding the best way to reach customers online and when fashion shops re-open.

Post-Lockdown Eclectic

Home-working leads to an individual mix of styles

Exercisewear and sport shoes have become important in enforced lockdown leisure.

Younger urbanites, back to work in London and other big cities, mix unusual fashion combinations – long printed floral dresses, Puritan prairie dresses, pleated maxi skirts with heels or sneakers.

Cargo pants worn with high heels. With lockdown beards and long hair comes a1960s-type energy to menswear, flamboyant colours, prints in linen and flowery cotton, silk.

The power of brands continues, at vastly different price levels; Reiss, Gucci, Alexander McQueen, H&M, Roksanda, Faithfull the Brand, Adidas, Converse, Nike, Asos, LoroPiana, Zegna, Burberry.

The craft industry and the DIY artisan movement boomed during isolation; likely to give rise to fashion exploring rustic effects, texture, and ‘imperfect looks’ in 2021.

Reshoring

More manufacturers consider shifts back to the UK

Sustainability is increasingly important to brands; consumer awareness is growing; young people ask for natural fibres and explanations on fashion origins.

De-globalisation and more local sustainable sourcing lie behind moves for reshoring, i.e. the ‘Make it British’ movement by Kate Hills. More manufacturers consider shifts back to the UK after problems following Covid-19 and for sustainable reasons.

Cycling is the mode of transport for urban travel, boosting all-weather activewear and accessories. Natural fibres and fabrics dominate the sustainable story.

USA

The Online Boom

As the stimulus euphoria wanes, and job losses deepen, consum

Initially, a backlog of merchandise prompted retailers to markdown apparel and goods, and as a result, online sales of apparel and accessories posted doubledigit growth in the US and the rest of the world, with even small to medium-sized companies boasting stellar sales growth in the months of March, April and May.

As the stimulus euphoria wanes, and job losses deepen, consumer confidence and spending is expected to slow. On a global level, Bain & Co’s latest Luxury Study for 2020 forecasts a contraction between 20 to 35 per cent for the full-year 2020, with a recovery expected in 2022 and 2023.

Science, technology and apparel and beauty are merging more than ever before, synergising to create a more eco-sustainable industry on the whole. Established brands like Levis, New Balance, Nike are trailblazing in that arena, while emerging brands like Reformation and Everlane are proving that eco, ethical and transparency has a true place in the luxury market.

The Spending Power

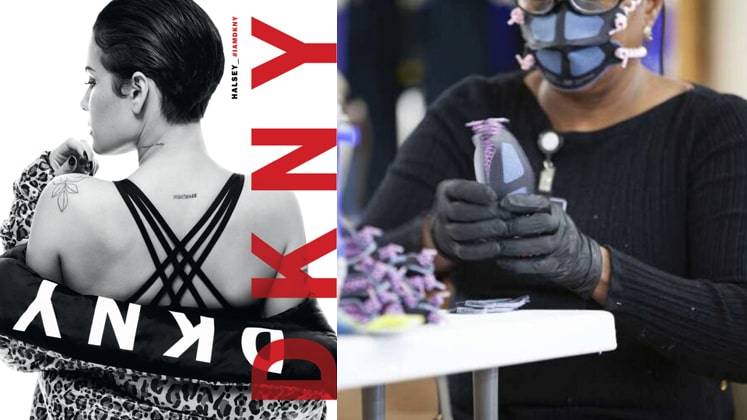

More collaboration between emerging labels and athletic brands

As the casualisation of men’s and womenswear goes on and more Americans continue to work from home and in their yoga pants, we will see many more collaborations between emerging labels and athletic brands.

Streetwear in the age of Covid will impact streetwear greatly as anti-viral technologies target the safety concerns of consumers and masks, gloves and face shields become the new norm on the streets. Streetwear brands are already heeding the call. When it comes to deciding the strongest sales areas in fashion, affordability is key. The 18 and 24-year-old demographic’s consumer choices will continue to be driven by their spending power, which will certainly be affected by the unemployment situation. Athleisure and athletic brands will likely continue to find success with footwear.

CHINA

Comfort First

The rise of street style

Comfortable casual and leisure-oriented clothes have taken over from formalwear as the mainstream choice of dressing for Chinese consumers. In addition, clothes with twists and something special in their design are also popular. Of course, with the pandemic, face masks were at the heart of the accessory market. Streetwear is very popular among youngsters, especially as the cultures and trends of different countries are converging and crossing over to each other. Street snap and outdoor live streaming in China are flourishing.

Slightly loose silhouettes and colourful clothes are the most popular looks with the young – they want to show a more unique, personal attitude when it comes to dressing.

The Rise Of Vintage

More and more Chinese consumers are looking to sustainability

Although sustainable clothing is still in its infancy in China, sales have increased a great deal in the past few years, which show how people are paying increased attention to environmental issues.

In terms of retail, this can be seen in the increased number of second-hand clothing stores and vintage shops being opened in big and medium-sized cities. Consumers see the purchase of secondhand clothes not just as a vote for the environment but as a fashion statement.

As is known, on-line stores form a huge part of the Chinese market and their development continues to blossom. Some of these do a very good job concerning sustainability. For e.g. HowBottle, specializes in making clothes from waste plastic bottles. REVERB by JNBY uses fishing nets and other ocean waste to make recycled nylon to manufacture clothes and bags; it also makes dresses with re-cycled cashmere.

INDIA

Following Indian Taste

More local than global

According to a report by Technopak, the Indian retail market is expected to show a promising year-on-year growth of 6 per cent to reach USD 865 billion, by 2023, from the current USD 490 billion. The apparel share is 8 per cent, corresponding to a value of USD 40 billion.

The incredibly unique Indian wedding industry also adds to the overall growth.

India is the only market globally, which is more ‘local’ than ‘global’ in terms of following trends. So, more and more young Indian designers are focusing on the domestic market which is vast. They don’t really cater to ‘Western Wear’, which is a completely different segment for them and better left to retail brands like Zara and HM in India with their inexpensive clothing and global styling.

Indian designers are sourcing ‘Made in India’ products that are sustainable, organic and contribute to the real Indian textiles fashion cycle and ecosystem. They are catering to IndoFusionwear and Indian traditional wear such as weddingwear, sarees and salwar kameez and other traditional clothing. Even though some do cater to international markets, they mostly cater to non-resident Indians which is a huge population outside India or they end up catering to an international clientele, who like ‘Made in India’ looks and ensembles.

A History Of Handmade

Eco-friendly or sustainable clothing is seeing steady growth

They have always been a part of Indian culture: The idea of ‘Eco-friendly’ or ‘Sustainable’ may be new in Western countries but this ideology has always been a part of Indian culture.

Indian consumers have been much ahead in adopting sustainable fabrics as handloom qualities are primarily easy to find in India.

What has been a good step forward is that Indian manufacturers are adopting better global practices in terms of international certifications to produce clothes that leave little impact on the environment.

In this entire current scenario, the new Indian home-grown brands, Indian retailers as well as India’s MSME sector – the medium and small-scale industries – have truly given a new face to Indian fashion, reviving ethical fashion trends.

Indian Fusion Wear

Celebrating heritage

Indian fashion-conscious consumers, including millennials, are both celebrating their Indian heritage and are proving themselves global fashion followers. More than ever, India’s consumers are busy localising world trends and turning themselves into global nomads.

Fusion Wear is extremely popular in India as it is not confined to any trend or any body type. However, more than ‘fusion’, we see an ‘anti-fit trend’ – an androgynous fashion style that combines both masculine and feminine characteristics. It’s an expression of the fashion freedom beloved of India at this moment!

ITALY

Comfort First

Homewear attitudes in outdoor dressing!

The one thing people are looking for at the moment is comfort. But in terms of actual looks, it’s a moment of polarisation; on one hand, as they emerge from lockdown, consumers feel the desire to wear something distinctive, creative, colourful with look-at-me details – shorter skirts or frills and ruches as feminine details on simple garments is one idea, without daring too much; on the other hand, the need for reassuring and soothing shades and elegant basics prevails, together with easy, comfortable shapes, where casualwear fuses with home and loungewear.

Colour because of its mood-influencing properties is important! Other key issues are: comfort; the simple but refined; precious details and playful elements; homewear influences into everyday outfits; utility wear; and elegant tech.

Increased Awareness

Progress but still much to do at consumer levels!

More and more people are becoming conscious about sustainability issues and the pandemic situation has only served to underline several aspects of them.

But, sales of sustainable clothing in Italy still form the minority part of the market by far, mostly because of poor consumer knowledge about the subject: some people are aware of certain brands associated with sustainability, but don’t really know where to find the merchandise.

Recycled items, second hand and handmade is gaining popularity as independent and small shops and brands are winning more customers because of the boom in online shopping and social media.

Positive Attitudes

The chance to transform

Textile and garment exports have been severely affected by the pandemic. However, exports of China’s industrial textiles (masks, protective clothing, disinfectant wipes, etc.) increased by 79.6 per cent from January to April compared to the previous year Although this pandemic is a heavy blow to many enterprises, it is also an opportunity for enterprises to transform and upgrade.

[**Intertek has been a trusted partner to the world’s leading brands, manufacturers and distributors in the fashion and textiles industry for 130 years with a wide range of assurance, testing and certification services, from footwear chemical testing to functional textiles testing, physical performance evaluation and more. With over 1,000 labs in more than 100 countries across the world and 46,000 Intertek experts, the company brings unparalleled knowledge and expertise on the major global regulations and trends]