The e-commerce boom hit the market like a wildfire, spreading throughout several regions at once. The Asian market today has one of the fastest growing trajectories in the space, and India’s growth is emblematic of the same, as it is expected to surpass the US to become the second largest e-commerce market in the world by 2034. As per statista.com, India’s retail e-commerce CAGR is projected to reach 23 percent from 2016 to 2021 and as per IBEF, close to 329.1 million people are projected to buy goods and services online in India by 2020.

In reality, the story behind this upward trajectory has been very dynamic, with different phases of creation and destruction of opportunities for different stakeholders of the industry. Initial years witnessed small and medium enterprises, putting up their old stock online, with the second phase beginning the game of discounting to entice more consumers. E-commerce came as a package which entirely changed the way sourcing or buying used to take place.

This discounting further squeezed in margins, until major big league brands entered the sector. Initially adopting e-commerce as a liquidation set-up, the brands later gave in to the toxic cycle of tighter margins with heavier offers. When bigger players such as Amazon hit the market, many smaller online set-ups started suffering and eventually fizzled out, as the concept of multi-brand online outlets that were ready to invest in inventories of their partner brands came into existence, later diversifying into consignment models. These online players did give visibility to the brands, but at the heavy cost of lower full-price sales.

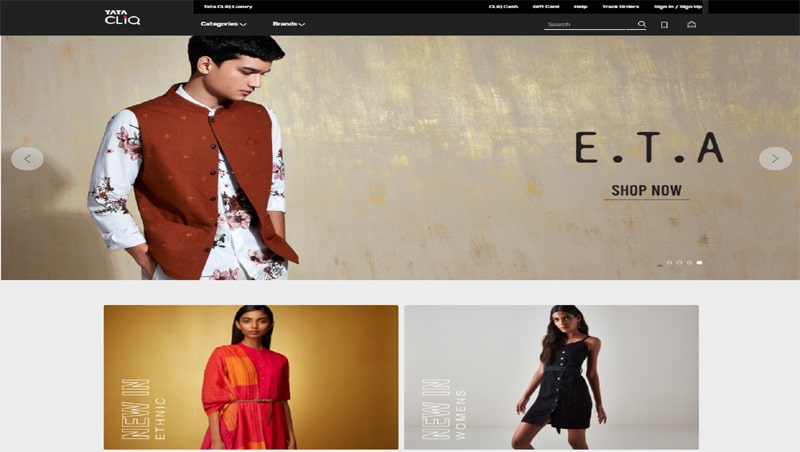

This created a gap for a place where the brand could thrive on its own terms and conditions, and this is where the concept of a 100 per cent marketplace was born. Tata Unistore’s e-commerce venture Tata CLiQ was the embodiment of this change, as it simply connected the store inventory which is already being funded by the brand, with the customer to give the products more exposure, thus making customers’ favourite brands just a ‘CLiQ’ away.

In a candid conversation with Apparel Resources, Pravesh Kaushik – Business Head, Apparel – Tata CLiQ, talks about how the e-commerce venture is planning to not only touch the lives of many customers throughout India, but also champions the brands in the best way possible.

Omnichannel to support brands and customers

Tata CLiQ targets the 10 per cent crop of customers that are loyal to the brands and would like to see it on multiple channels, and it simply asked these brands for an access to their stores, to connect the brand loyalists to these outlets, in order to make the full-price sales get traction. “Our biggest highlight is that we do not interfere with how the brand is selling. The Tata brand name creates a trust in the customers, and secondly, the customers can see that brand’s voice is coming to them clearly; it’s Superdry speaking to them, it’s Westside speaking to them, there are no intermediaries,” says Pravesh.

This enables brands to maintain their image while enjoying a presence on multiple fronts. To increase this accessibility, CLiQ is defining the way omnichannel works, with options such as ‘QUiQ’ (click & pick) or ‘Ship From Store’ and ‘Return To Store’. The former talks about saving the customer’s time, as he has the option to search the entire merchandise offering while sitting in his office and then simply pick it up while going home. This in turn increases the walk-ins of the customer and adds to the chance of the in-store experience.

“There is a lot of abuse around the word omnichannel,” Pravesh expresses, “Providing an online channel to actually ship the product to the consumer does not define that word, because the customer cannot go back and return the merchandise to the nearest store, neither can he/she pick it up. In fact, it will not even have the brand’s original bill. Tata CLiQ was the true embodiment of omnichannel presence as anyone can buy a product from Tata CLiQ and simply return or exchange it by visiting the store of the product, and even redeem the money back.”

In fact, to enhance the online to offline connection, the e-tailer is working on a disrupting technology called ‘geofencing’, where a Tata CLiQ user will be notified of his favourite stores if he is within the vicinity of a few kilometres. In fact, this notification will come with the store-exclusive offers of that particular outlet, which may or may not be present elsewhere, giving brands a thorough visibility with the aid of geo-tagging. “At the end of the day, Tata CLiQ has to network with the brand and the consumer both, and this is the way to go. This means moving people from unknown territories to the store.”

The testing of the same is happening in the Mumbai region to gauge the reaction of both customers and brands. Overall, it has been a promising avenue as brands such as Mufti, Superdry, Westside are excited about it.

Quoting the example of Westside, a retailer which has only Tata CLiQ as its e-commerce channel, Pravesh talks about how they empower the brands by giving them monopoly, “Having Tata CLiQ as its sole e-commerce partner was a very strategic decision on Westside’s part, as they are very particular about their brand image. They didn’t want their bricks-and-mortar customers to feel cheated due to heavy discounting online, which is why they have partnered with Tata CLiQ, as we make sure that the pricing is exactly as per Westside’s choice. They wanted an environment which is conducive to their true representation of offline.” To further the brand’s monopoly, Tata CLiQ has also created a space on its portals dedicated to Westside, which actually mirrors how the retailers own website would look like. Tata CLiQ is also working with Arvind’s multi-brand store, ‘Unlimited’ in the same manner. “These brands are not a part of Tata CLiQ, it is Tata CLiQ that is a part of them,” says Pravesh.

Empowering the new

Despite being a curated, branded marketplace, CLiQ keeps about 5-10 per cent space for upcoming brands, especially the ones created by manufacturers who are exporting to big names such as H&M, Zara, etc., while running parallel retail businesses, as they are well versed with trends and have the power to translate them. These suppliers and small to medium enterprises are first evaluated on the basis of their product offering, whether it is complimentary to the assortment or the product fills in the gaps pertaining to pricing range, product category, sizing, etc., or simply, if it is a new addition to the entire lot.

Secondly, it is evaluated if the value of the product is justified, and finally, a thorough quality check in terms of materials, trims, sizing, pricing, etc., is done. Before onboarding the brand, it is given a pilot run to perceive the customer response, as Pravesh avers, “We are obsessed about customer feedback, and the response is calculated in terms of NPS – Net Promoted Score. Even if the brand is selling well but the NPS is low, then we know that the customer is giving favourable feedback. We thus advice the brand to improve its quality or move the brand out.”

Many of these small brands are now thriving on CLiQ, but the density of sales when it comes to branded vs. nonbranded is different for menswear and womenswear. 90 per cent of menswear sales comes from the branded apparel space, with the most popular brands being Superdry, Van Huesen and Mufti, while on the other hand, womenswear branded apparel sales constitutes 60 per cent of the sales chunk, as women tend to follow trends rather than brands. In womenswear, AND, Global Desi, W, Westside formulate the top choices.

Talking about the way the industry is changing and the strong position that Tata CLiQ holds, Pravesh explains, “This is a time, especially in the last six months, where people are aware of how the online retailers are performing due to governmental reforms; the paradigm is shifting. A brand might get enticed by other players in the market who work on inventory models, but our target audience are the brand loyalists, the people who love to shop clothes because they love the brands. The volumes might be present with the inventory-controlling online retailers, but the brand loyalty and conversion lies here at Tata CLiQ, it is the density of orders over numbers that matters.”