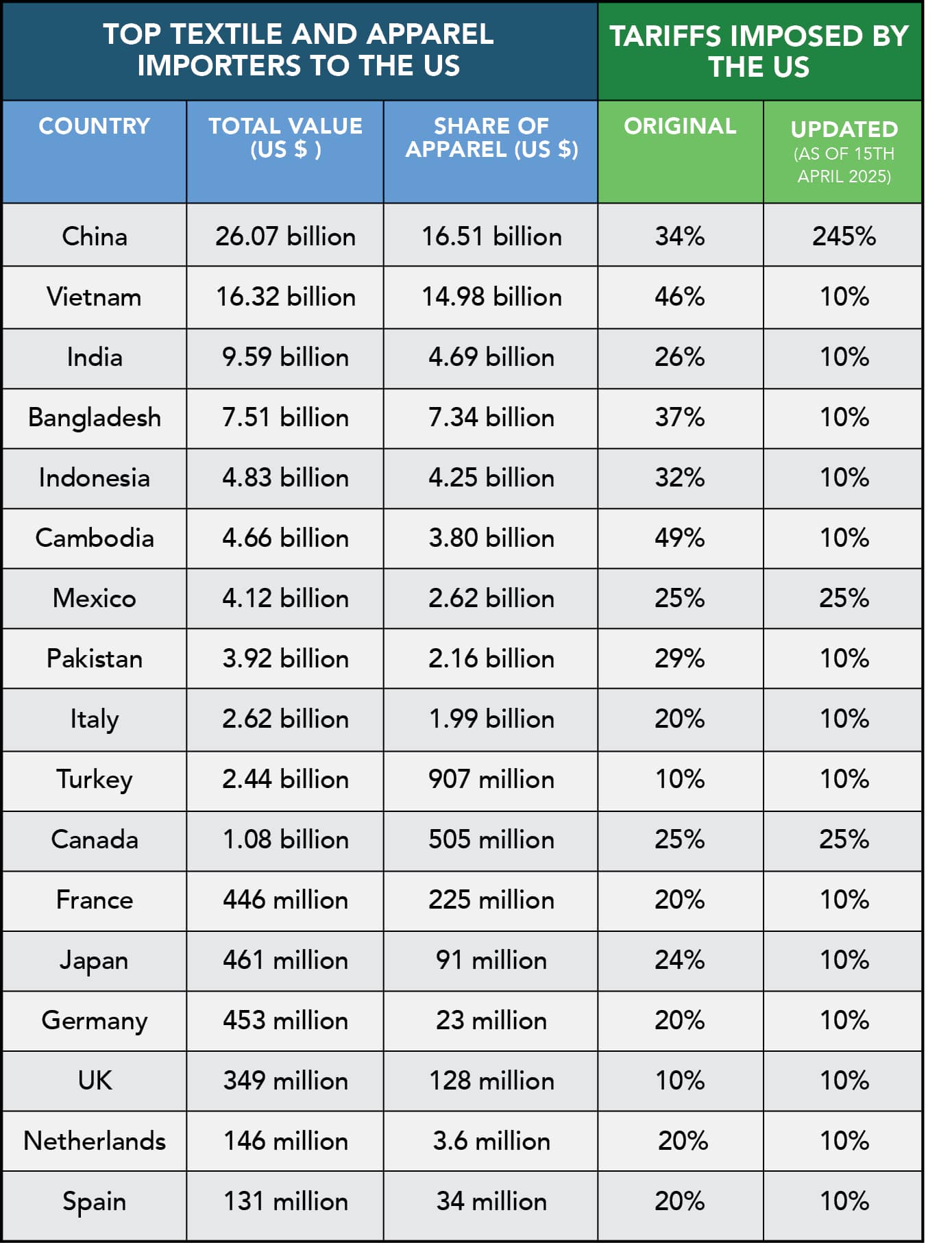

With the latest tariff revisions by the United States, a clear message has been sent: the era of overdependence on China is ending. As of now, Beijing is the only major apparel-exporting nation facing a steep 245 per cent tariff, a massive jump from the earlier 34 per cent.

This shift presents India with a golden opportunity to step up and take the lead as it’s better positioned than most of its competitors, even in the wake of the US temporarily suspending tariffs for many other countries. Here’s why.

At first glance, Vietnam and Cambodia might seem like the biggest winners of the US’s 90-day tariff waiver, but, both countries have long played the role of proxy hubs for Chinese companies. Vietnam, in particular, has become a popular choice for Chinese firms because of its shared land border, making it easier to move goods and equipment.

Vietnam has a huge trade deficit with China. In 2023, Vietnam exported US $ 61 billion worth of goods to China, while importing US $ 144 billion.

Vietnam is seen as a way for China to bypass US tariffs. A lot of Chinese goods are being rerouted through Vietnam and many exports from Vietnam to the US contain Chinese parts or are shipped after minimal value addition.

The US is also worried about its growing trade deficit with Vietnam, which reached US $ 123 billion last year, three times higher than it was in 2018. This has led President Trump to suggest that China is trying to ‘screw’ the US by using Vietnam as a partner.

Similarly, Cambodia is seen as another proxy for China. This is because of a Free Trade Agreement (FTA) between China and Cambodia that started in 2022, which gives Chinese exports to Cambodia preferential treatment.

What about Mexico? While Mexico remains an important trade partner for the US, with US $ 505.9 billion in imports and US $ 334.1 billion in exports in 2024, the overall goods trade deficit stood at US $ 171.8 billion. As a result, the US has maintained a 25 per cent tariff on Mexican goods.

Mexico’s main exports to the US include vehicles, auto parts, electronics, machinery and agricultural products. Textiles and apparel represent a relatively modest share of the overall trade.

Within this, apparel (HS Codes 61 & 62) makes up over 57 per cent of Mexico’s total textile and apparel exports to the US. The country is also amongst the top five denim suppliers to the American market. Home textiles and other made-ups account for roughly 18 per cent, while footwear contributes around 10 per cent of textile-related exports. Though the country provides some opportunities due to nearshoring, but with tariffs still in place, there’s a risk that brands may shift orders to lower-cost Asian countries.

Even Bangladesh, India’s closest competitor, suffers from credibility issue due to ongoing political instability, making global brands wary. On top of that, wage disputes and energy crisis are making things even harder.

Can India seize the moment?

Though its apparel exports to the US currently stand at US $ 4.69 billion, India is preparing to rapidly scale that number. Not only does India have the manufacturing capability, but it is also moving swiftly on the diplomatic front to seize the opportunity. India is amongst the first countries to initiate formal trade talks with the US following the tariff shake-up. The two nations agreed in February to work toward the first phase of a broader trade deal, with a shared goal of hitting US $ 500 billion in two-way trade by 2030. That momentum, combined with the current geopolitical climate, gives India a serious edge. India is also preparing its internal systems to handle this shift. The government is increasing scrutiny of imports, especially from China, to curb dumping and protect domestic industries.

On the ground, India already possesses a powerful ecosystem. From its large skilled workforce to well-established production hubs and its abundant access to cotton and other raw materials, India offers both scale and variety. In addition, government-backed initiatives like the PM MITRA Parks, Make in India and ongoing investments in infrastructure are helping companies expand their capabilities to meet rising global demand.

However, whether India can truly capitalise on this moment remains uncertain. After all, the country has a history of missing critical opportunities. In fact, we have already missed eight such chances since 2000s. In 2005, it lost out on the post-quota textile export boom to Bangladesh and Vietnam due to better pricing and efficiency. In the 2010s, it missed the chance to benefit from small-order quantities in e-commerce due to inefficiencies. After the 2013 Rana Plaza disaster, India couldn’t attract global brands seeking safer alternatives. During the US-China trade war (2018-20), India struggled with high costs and missed out on the shift in demand. In 2020, during the pandemic, India failed to take advantage of disrupted supply chains due to delays and labour shortages. It also missed out on the global PPE market in 2020 because of regulatory confusion. Despite signing multiple Free Trade Agreements, high costs and competition limited the country’s effectiveness. Lastly, during the 2021 Uyghur cotton embargo, India couldn’t fill the gap left by US ban due to higher production costs.