DHL eCommerce’s 2025 Trends Report finds that 77% of online consumers in the region leave their carts behind when their desired delivery options are not provided. The DHL eCommerce report pools the insights from 24,000 consumers in Asia Pacific, Europe, the Americas, Africa and the Middle East.

Furthermore, three out of four shoppers abandon the checkout process when the return experience does not meet expectations, highlighting the increasing importance of trust and transparency in last-mile logistics. Interestingly, 65% of respondents indicated they would not purchase from retailers whose return partners they distrust.

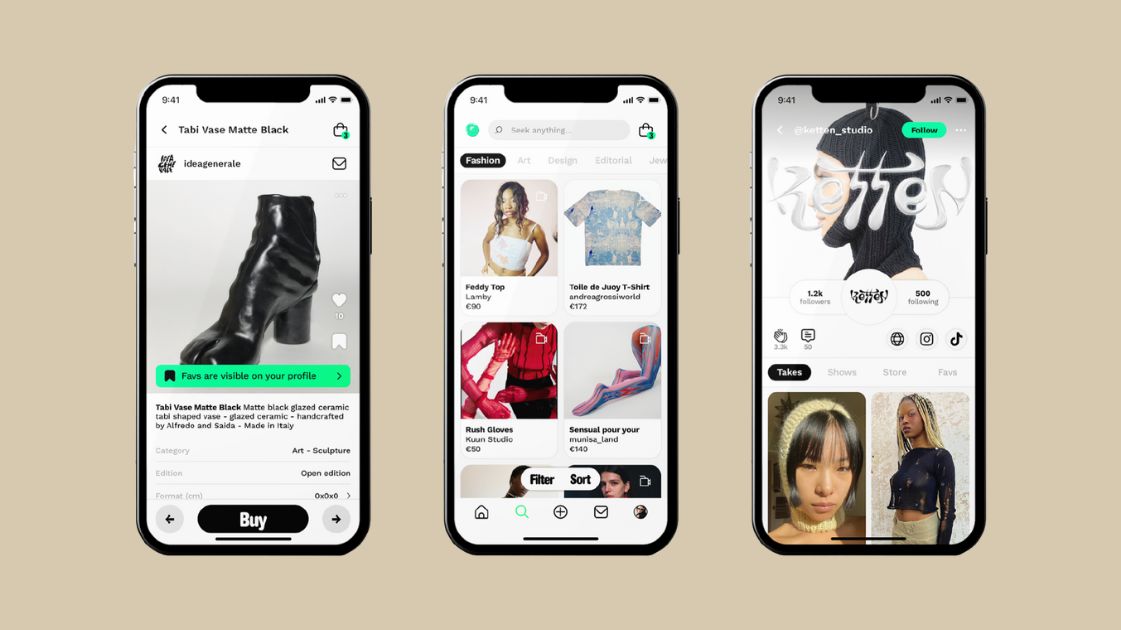

At the same time, social commerce is booming throughout APAC, with the forecast that by 2030, 85% of customers will be making most of their purchases directly from social media platforms, effectively by-passing traditional online shops.

The demand for AI-facilitated shopping is also increasing. From try-ons in digital space to voice-activated browsing, 81% of consumers in the region are relying on artificial intelligence to enhance their buying choices. Already, almost half (47%) of APAC consumers are already using voice commands to make hands-free purchases.

The social media influence has become very strong, with 87% of APAC consumers stating that their purchasing behaviours are influenced by viral trends. TikTok is driving the trend in nations such as Thailand and Malaysia, where 86% and 81% of online shoppers, respectively, have made purchases on the app.

Almost three quarters of APAC online shoppers (79%) consider environmental impact when making an online purchase. The feeling is most apparent in India, where 92% of consumers believe that sustainability is an integral part of their decision. Environmental issues are now leading to action—49% of consumers have abandoned a purchase based on issues related to sustainability.

More than half (52%) of consumers in the region are opting for used or refurbished products, driven both by environmental-consciousness and thrifting. In addition, 72% say they’re interested in retailer-sponsored recycling or buy-back programs. In China, that percentage increases to 85%.