Decathlon plans to double sourcing from India to US $ 3 billion by 2030, with strong emphasis on technical textiles and high-potential categories (Reuters). ASICS India forecasts a 35–37% Y-o-Y growth in revenue for 2024–25, alongside Government-led expansion in local production. TechnoSport, India’s fastest growing sportswear and athleisure brand has clocked approx. Rs. 600 crore revenue in FY 2024-25 (www.apparelresources.com). All of the above paint a rosy picture for the Sportswear MMF fabric market in India. On the other hand, the Indian government’s QCO (Quality Control Order) on MMF supply chain is receiving mixed reactions from industry quarters for supposedly throttling the MMF-fibre use for domestic consumption. What’s so special about this MMF? Why is there a need to import? Why can’t India produce enough? We will try to find answers to these questions.

US $ 1.66 BnIndia’s sports fabric market is estimated to be approx. US $ 1.66 billion with polyester having 60% share in it (i.e. US $ 1 billion) and Dry-Fit microfibre (0.5–1.2 dpf) share is further 50–70% of it (i.e. US $ 500 – US $ 700 million). |

What is special about polyester sportswear fabric?

The micro denier version of polyester fibre opened a new chapter in active sportswear and athleisure categories globally. Moisture-wicking, moisture transport system, sweat-absorbent, breathable Dry Fit, dry comfort during workouts are some of the claims that brands make as performance features wooing consumers towards this product. At the core of the promise lies a humble specification of polyester fabric; so called ‘dry-fit’ polyester made out of 0.5 – 1.2 dpf polyester filament yarn.

This polyester filament yarn is converted to either knitted or woven fabrics which are used in sportswear. There are mills in India that can convert filament to fabric and the new investments under PLI scheme like Shahi-Little King, TechnoSport etc. are aimed towards fabric manufacturing; that means the filament yarns will be needed as raw material. Although the break-up of how much of the domestic demand is fulfilled by yarn import or fabric import is not available, from the industry’s reaction of QCO, it is assumed that a significant proportion of filament yarn is currently being imported. From the QCO (across MMF value chain), the Govt. intention is clear – development of self-sufficiency in filament yarn making as well as fabric making.

PRACTICAL IMPLICATIONS FOR DRY-FIT ACTIVEWEAR FABRICS

|

How much is the demand for polyester sportswear fabric?

The big five (Nike/Adidas/Puma/Lululemon/Under Armour) together clocked annual revenue of approximately US $ 43.35 billion globally from apparel (excluding shoes) in 2024-25. Although corresponding figures of India are not available, alongside the big five, there are hundreds of homegrown brands that today offer ‘dry-fit’ polyester. Amazon lists 11, Myntra lists 6 and Flipkart lists 10 such homegrown brands justifying the appetite for India’s burgeoning need for Dry-Fit microfibre (0.5–1.2 dpf) polyester.

India’s sports fabric market is estimated to be approximately US $ 1.66 billion with polyester having 60% share in it (i.e. US $ 1 billion) and Dry-Fit microfibre (0.5–1.2 dpf) share is further 50–70% of it (i.e. US $ 500 – US $ 700 million). At US $ 2000 per tonne, it means that India requires/consumes 250,000 to 350,000 tonnes of Dry-Fit microfibre (0.5–1.2 dpf) polyester annually!

How much is India’s installed capacity of filament manufacturing?

Three different types of polyester filament pop up whenever we talk of sportswear fabric: POY (Partially Oriented Yarn), FDY (Fully Drawn Yarn) and PTY / DTY (Textured Yarn). POY is an intermediate feedstock (needs drawing/texturing), flexible to be converted into DTY/FDY and economical for producing micro-denier DTY. While FDY is smooth, dimensionally stable, good for lightweight/ smooth jerseys and warp-knits and, it can give very fine dpf when supplied with high filament counts. PTY / DTY (textured yarn) is texturised POY/ FDY giving bulk, stretch and soft hand — usually the best choice for circular-knit activewear (Dry-Fit). It is soft, lofty, with more cotton-like feel.

It has high bulk/loft that creates the porosity and air channels for wicking and insulation. Let’s now assess the domestic capacity of FDY and DTY polyester filaments in India.

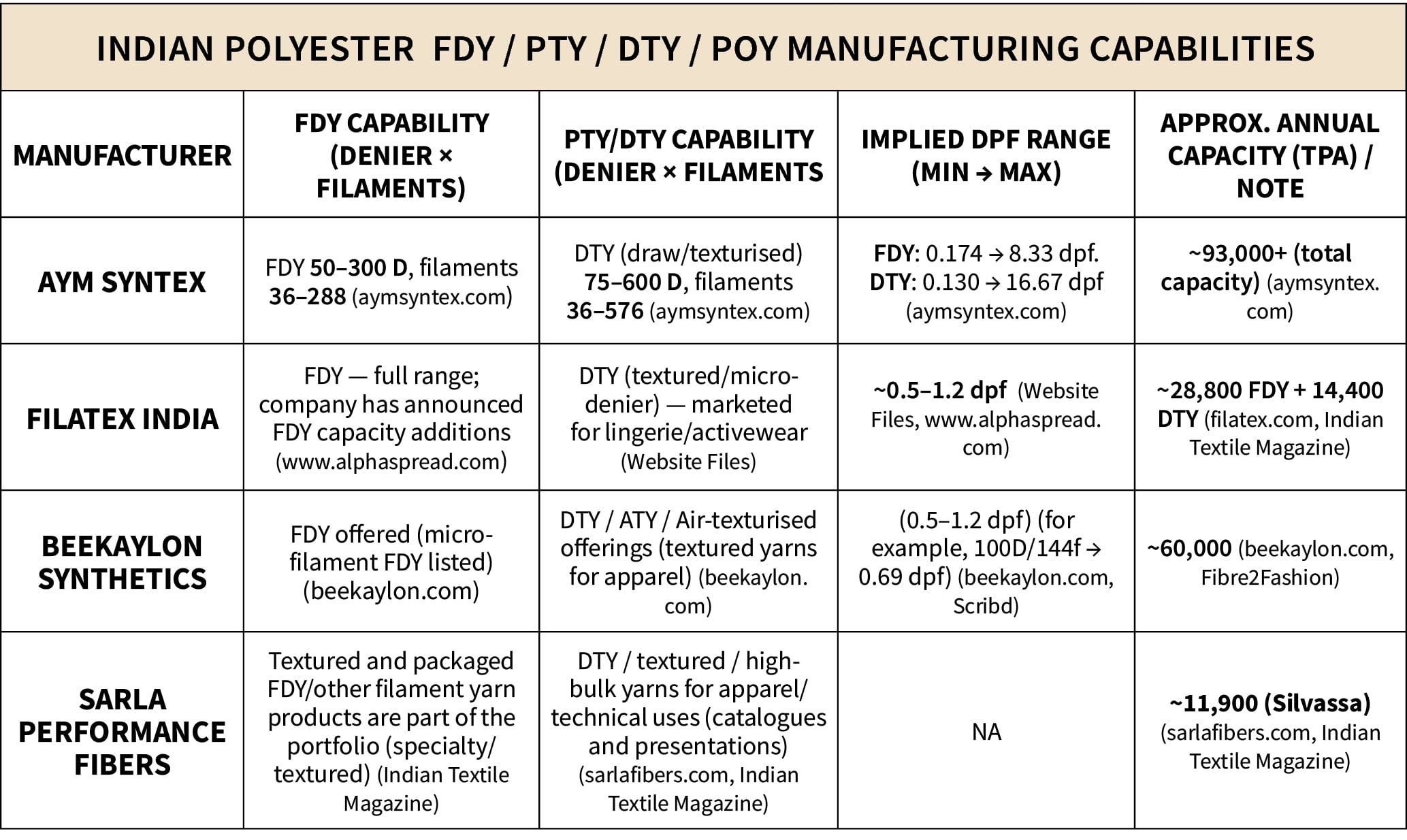

Reliance is India’s polyester powerhouse and produces 2.5 million tonnes of polyester (FDY / PTY / DTY / POY combined) per annum, although how much of it is 0.5 ~ 1.2 dpf range is not clear! Additionally few other manufacturers cumulatively produce around 2 lakh tonnes of FDY/PTY/ DTY polyester annually, some of them specifically in the microdenier range which should be enough to take care of India’s domestic requirement! So, why is there a need to import?

If India has to set up additional capacity in filament manufacturing?

If India has to set up additional capacity in filament manufacturing?

In the worst scenario if we imagine that most of the Indian FDY/ PTY/DTY produce are not suitable for sportswear fabric or most of it are exported (not available for Indian manufacturers), and that is why India needs to import and QCO is hurting the Indian sportswear manufacturers. Then the question is how difficult is it to set up a new plant?

As per information available, there are only four machinery manufacturers / suppliers globally for POY/FDY/ PTY/DTY polyester filament: Oerlikon Barmag, JWELL Machinery, Rieter/ Saurer and TMT. As usual two are Chinese, two are European and none from India.

Also Read: India Builds Its Activewear Empire

Any manufacturer in the world, be it in India or anywhere else has to use any of the four machinery suppliers to set up a polyester filament manufacturing plant. What is stopping Indian entrepreneurs or corporates from setting up additional manufacturing capacity? How much does it cost? We have tried to calculate a typical investment required to set up a polyester-filament plant with micro-denier capability (0.5–1.2 dpf), shown separately for above four machinery suppliers. Equipment required are pinning (extruders + spinpacks/beam + POY/FDY spinner), draw-texturing machines (false-twist/ air-jet for DTY/ATY), winders, godets, control systems, QC lab instruments and some spare parts. While a full project / turnkey CAPEX range requires equipment + land/civil + utilities + installation + commissioning + initial working capital. Two plant sizes are shown below so one can pick what’s closest to their plan:

Small pilot / boutique = 1,200 tonnes per annum (TPA).

Medium / commercial = 6,000 tonnes per annum (TPA).

Although the recent capacity expansion by Filatex, AYM Syntex and Sri Durga Syntex and new investment by Garden Vareli mention polyester filament manufacturing, little is clear about whether ‘micro denier’ capability is being created or not? While Shahi Exports and Little King JV specifically mention MMF fabric manufacturing capacity (and not filament manufacturing). Under PLI scheme, there are as many as 14 organisations already committing Rs. 300 crore and above investment, so at US $ 20 million (Rs. 200 crore) upper bracket, investment in a polyester filament plant with micro denier capability is not too prohibitive for Indian giants. But there may be a multiplicity of business reasons (too little demand, soft expertise unavailability) why many are not keen to set up the filament plant. We have to wait and see…