Everyone knows Cristiano Ronaldo is the most followed person on Instagram, but which Indian D2C apparel brand dominates the platform?

With 413 million monthly active Instagram users in India as of March 2025, mostly aged 18 to 34, the competition for attention is fierce.

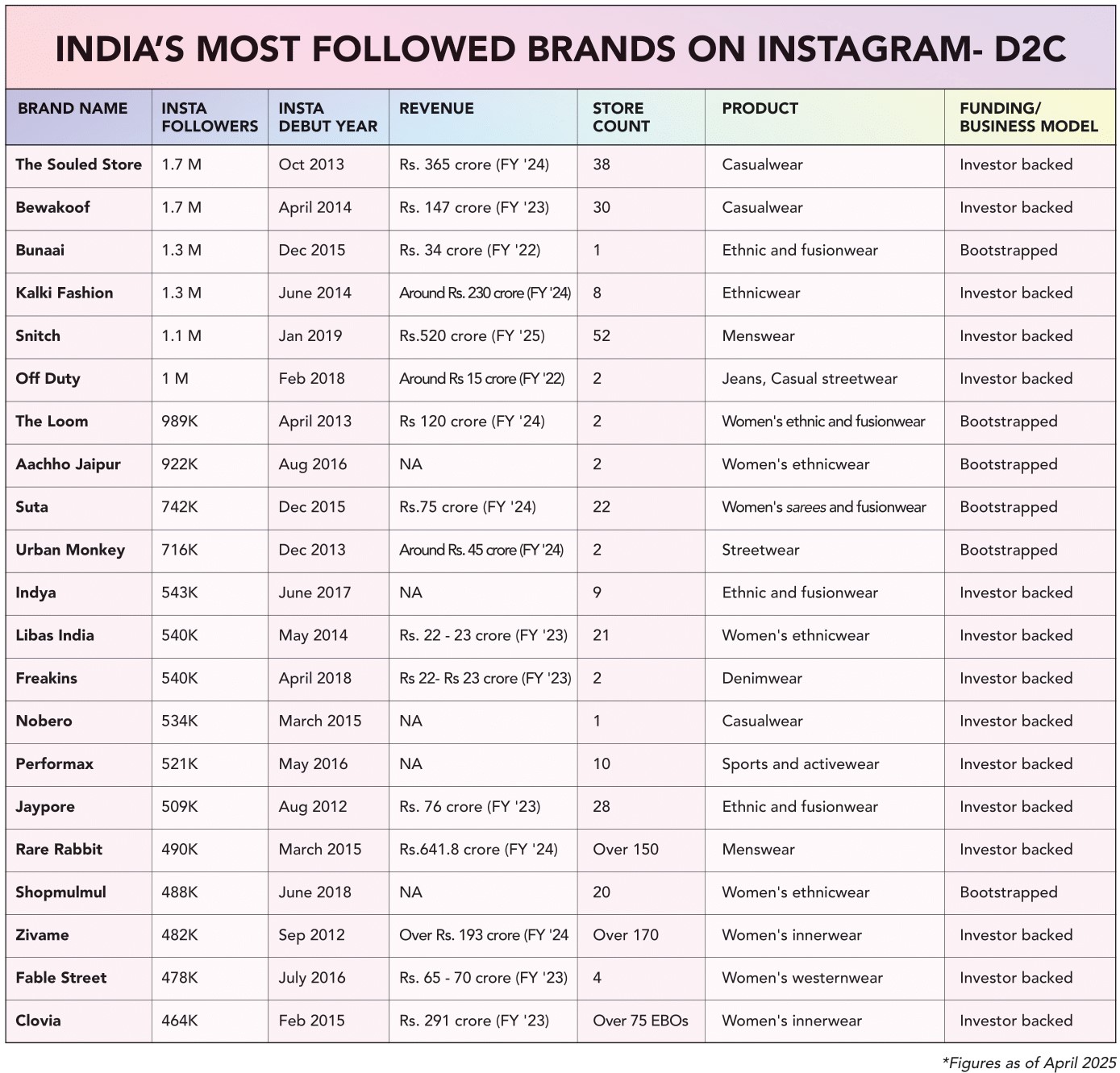

We did the digging, crunched the numbers and put together the ultimate list of the most-followed Indian D2C apparel brands on Instagram. But the list is not just about the numbers, there are some really interesting insights too!

No Link between Followers and Revenue

The biggest takeaway? Having more followers on Instagram doesn’t always mean higher revenue or strong financial success. And the same goes the other way, fewer followers don’t mean less revenue or profitability. At best, a big follower count gives you bragging rights over others, but that’s about it!

Take Bewakoof, for example. It shares the top spot with The Souled Store, but according to recent reports, Bewakoof, now owned by Aditya Birla Group’s TMRW, faced cash losses of Rs. 79.47 crore (US $ 9.27 million) in FY ’24 and Rs 69.28 crore (US $ 8.1 million) in FY ’23.

| 166K followers per year since its debut in 2019 make Snitch the fastest growing brand on Instagram. |

Even The Souled Store, India’s leading pop-culture merchandise brand, turned profitable last year. The start-up reported an EBITDA profit of Rs. 18.6 crore (US $ 2.17 million) in FY ’24 as against an EBITDA loss of Rs. 8 crore (US $ 933,000) in the previous year. EBITDA margin improved to 5 per cent from minus 3 per cent in the previous year.

Surprisingly, Rare Rabbit, a premium fashion brand run by The House of Rare, leads in revenue with Rs. 641.8 crore (US $ 74.91 million) in FY ’24, yet it ranks only 18th on our list with 479K followers. Still, the brand is doing extremely well financially, with profits growing 2.3 times to Rs. 70 crore (US $ 8.17 million) in FY ’24.

This lack of connection between followers and revenue is even clearer with Off Duty, a premium denim brand. It has over one million followers, but its revenue in FY ’22 was just Rs. 15 crore (US $ 1.75 million). Even if we assume it doubled to Rs. 30 crore (US $ 3.5 million) in FY ’24, it’s still far behind many other brands on the list.

This pattern continues with other brands too. Zivame, an innerwear brand, has 476K followers but made over Rs. 193 crore (US $ 22.53 million) in revenue in FY ’24, a 42 per cent fall since the last financial year. Meanwhile, FS Life, earlier known as Fable Street, with a similar number of followers, reported a much lower revenue of around Rs. 70 crore (US $ 8.17 million) in FY ’23.

Another innerwear brand Clovia has the fewest followers at 458K but still made Rs. 279 crore (US $ 32.56 million) in FY ’24. In contrast, Urban Monkey, a streetwear brand, has 712K followers but reported only Rs. 45 crore (US $ 5.25 million) in revenue in FY ’23.

| Having more followers on Instagram doesn’t always mean higher revenue or strong financial success. And the same goes the other way, fewer followers don’t mean less revenue or profitability. At best, a big follower count gives you bragging rights over others, but that’s about it! |

Which D2C Brands are Gaining Followers the Quickest?

Our comparison also proves that being an early adopter of Instagram doesn’t always mean faster growth. Some brands such as Snitch and Off Duty have mastered digital marketing to gain followers at a rapid pace while others have taken years to establish their presence.

Snitch is the fastest-growing brand on Instagram, gaining 166K followers per year since its debut in 2019. Close behind is Off Duty, which has been adding 142K followers per year since 2018, followed by Bunaai at 144K per year since 2015. Aachho Jaipur, an ethnic fashion brand, has also shown strong Instagram growth, gaining 114K followers per year since 2016. The Souled Store and Bewakoof, both debuting in the early 2010s, have grown at the same pace, each accumulating 130K followers per year since 2013 and 2014, respectively.

Urban Monkey, despite launching in 2013, has seen a slower pace, growing with 59K followers per year. Rare Rabbit has gained 43K followers per year since 2015, while two of the oldest brands on the list, Zivame and Jaypore, a premium artisanal lifestyle brand from Aditya Birla Fashion and Retail, have grown with just 36K and 39K followers per year, respectively, since their debuts in 2012.

Ethnicwear Dominance

Ethnicwear brands have a strong presence on this list. The 21 D2C brands on this list have a combined total of 16.87 million Instagram followers. Amongst them, ethnic and fusionwear brands dominate, with nine brands—Bunaai (1.3M), Kalki Fashion (1.3M), The Loom (984K), Aachho Jaipur (915K), Suta (737K), Indya (542K), Libas India (533K), Jaypore (508K) and Shopmulmul (486K)—collectively accumulating 7.31 million followers. That’s 43.3 per cent of the total followers, highlighting their popularity. Their success can be attributed to a strong focus on festive and weddingwear and visually rich content that connects with their audience. As of FY 2023, the Indian ethnicwear market is worth US $ 20.9 billion, yet the total revenue of these leading brands makes up less than 0.61 per cent of it. In contrast, the westernwear market is on track to reach US $ 77 billion.

Self-Made vs. Investor-Powered

Self-Made vs. Investor-Powered

Out of 21 top brands, six are bootstrapped. Amongst them, The Loom, an online women’s fashion brand, has the highest reported revenue at Rs. 120 crore (US $ 14.01 million), followed by Suta at Rs. 75 crore (US $ 8.75 million), Urban Monkey at Rs. 45 crore (US $ 5.25 million) and Bunaai at Rs. 34 crore (US $ 3.97 million). The revenues of Shopmulmul and Aachho Jaipur are not disclosed but are expected to be in the similar range. These brands have grown naturally by focusing on storytelling and building a strong community rather than spending heavily on marketing.

In comparison, funded brands generate much higher revenue, with Rare Rabbit alone earning Rs. 641 crore (US $ 74.82 million) annually. Many of these brands are also heavily investing in offline expansion such as The Souled Store, which currently has 36 stores and plans to reach 200 by 2026, Snitch, which aims to launch 100 stores by the end of 2025 and Rare Rabbit, which plans to add 10 more stores next year.