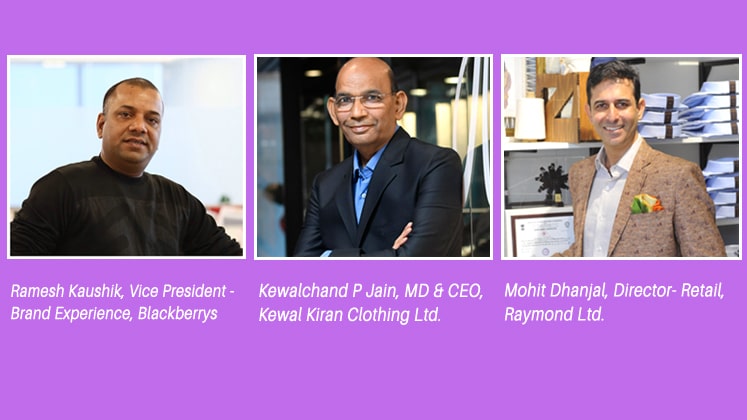

Retail is all about relevance and being present at the right location for the right set of customers is a must for the success of bricks-and-mortar retail business. While location intelligence is one thing that can drive in sales and revenue and enhance brand visibility, the time now demands retailers to concentrate even further on the size of the store as per the location, the neighbourhood, the expected footfall and the probable RoI on the rental cost, to move forward in a market as competitive as that of India. “As a brand, our effort is more around the location and then the second preference is the size of the store which is decided according to how conducive it is to the brand on the basis the location. House of Blackberrys stores offer an entire wardrobe collection for Indian men which range from casuals, formals to denims, accessories, footwear and innerwear, which ideally need space of around 1,500 sq.ft. but there are times when we have a good location but the area available is small. In such cases, we opt for small-sized stores and play with the merchandise mix and this works greatly for the brand,” affirms Ramesh Kaushik, Vice President-Brand Experience, Blackberrys.

Retail firms have understood the relevance of sizes while opening an offline store and have gradually moved past the notion that ‘bigger is always better’. Today, big box brands and retailers are going small and this is the new trend and a more realistic expansion strategy in the industry. Even as the debate is around whether retail is dead or dying, the industry has maintained that it is yet evolving with every next step. Across the world, even when a number of retailers are shutting their stores, majority of them are going in for a new expansion strategy which says ‘small is the new big’.

The inception of a new trend

The trend really took off from United States with Target being the frontrunner claiming that all its openings in 2019 will be small-format. Averaging 17,000 sq.ft. each, these small format stores are 15 per cent the size of traditional Target outlets. Besides Target, other big box retailers are adapting too by opening small-sized stores thereby reducing rental costs, offering specialised stocks to more targeted consumers among other advantages. This has percolated to the interiors of the market so much so that sales in small format stores are already projected to grow almost 4 percent annually in the next four years in United States.

In India, Future Group had identified small format stores as the first of the five pillars which are part of the long-term retail strategy of the firm and subsequently opened a number of stores in various formats. The trend soon flowed down to the fashion retail brands including the likes of Mothercare, Kewal Kiran Clothing Ltd. with K-Lounge that offers brands like Killer, Lawman Pg3, Integriti and Easies, Raymond with its Mini TRS stores, Blackberrys, among others, which cut down the size of their stores to improve their revenue per square feet. While Raymond’s Mini TRS is optimised at 800 sq.ft. as against its average store size which ranges between 2000-2500 sq.ft., the smaller format stores under KKCL span between 500-700 sq.ft. even as Blackberrys stores in this category cover an area of 550-750 sq.ft.

“Raymond realised the potential and importance of emerging markets beyond Tier-1 cities very early and gradually expanded its reach to the hinterlands of the country. In order to facilitate this expansion, we developed new retail business model in the form of small-sized stores which are called Mini TRS stores. We established these stores in order to reach out to such markets in a relevant and engaging manner with a dedicated brand store. We have rolled out over 303 stores in past 24 months which is the largest store roll out in men’s fashion and lifestyle category. We piloted this new business model in September 2016 and then perfected it over 6 months and commercially launched in March 2017. We can set up these stores in 15-30 days as compared to 90 days for the bigger stores,” prides Mohit Dhanjal, Director-Retail, Raymond Ltd. Almost 35 per cent of all the Raymond stores are small format ones and are present across the emerging towns of India. Small format stores not only reduce the costs – both operational and rental – but also act as pilot stores to gauge interest in Tier-2 and Tier-3 markets. Blackberrys looks at expansion at two levels – geographical and pure play sq.ft. expansion. “We look at other consumer allied industries in a particular location and interpret the market before opening the brand doors anywhere. For example, if Apple or a good smartphone company has opened a sizeable display centre in a city, these are the cues which give us an idea about the per capita consumption behaviour of a particular area which helps us decide if we want to be present in that market or not. And smaller sized stores prove to be a better decision for these areas where we are still testing the waters,” asserts Ramesh. For these stores, brands create a portfolio that is much sharper and more relevant for the customers in the area.

What’s driving the growth of the trend?

The trend of smaller stores is taking shape in a big way in India wherein even Ikea is departing from its large warehouse-size store formats and is planning to open few smaller outlets and the first truncated version is to be launched in Mumbai. So, what exactly is driving this trend? “A number of retail chains are opening smaller stores in a bid to gain scale, overcome paucity of real estate and grow fast. Small format stores allow companies to test their products and ideas without having to invest in traditional huge commercial spaces. These stores are meant to draw in busy, young professionals and families in the area. Furthermore, these outlets help in expanding the brand visibility and its reach penetrate the deeper pockets when compared to larger stores which operate with certain demographics. We have small, medium and large format stores under Killer Lounge which houses Killer, LawmanPg3, Easies, Integriti and Desi Belle,” avers Kewalchand P Jain, MD & CEO, Kewal Kiran Clothing Ltd.

With the pace at which infrastructure development is taking place including the new clusters of residential and commercial areas, rising affluent population, changing lifestyles, the truncated version of stores is aimed at fuelling the demand by its sheer presence in areas with majority footfall. For Blackberrys, it is a very calculative decision and rather than reducing the store size, it’s more about rationalising the store. “At the end of the day, every retail brand has to do more sales. So, if people by default are visiting a particular stretch for their regular shopping, it is necessary for the brand to have a visibility there. For example, Kamla Nagar in Delhi has small sized stores but one sees most of the brands including Blackberrys available there. Furthermore, small sized stores facilitate in maintaining the per sq.ft. profitability that the store has to offer. Every additional sq.ft. comes not only with rental but also operational cost as well and so opting for a 1,000 sq.ft. store instead of a 2,000 sq.ft. outlet which gives the same revenue makes more sense for us,” stresses Ramesh.

Besides being low on rentals, etc., the cost of visual merchandising and designing of the store are also economical even as other factors like faster roll-out because of easier availability of smaller floor plates, better throughput and profitability per square feet, personalised customer service, make this format an attraction for the retail brands. For Raymond, the zip format has added incremental revenue and income to the company since they have opened in completely new markets and towns.

What the future has in store?

Even as the small format trend is widening in both Europe and Latin America owing to youth fashion culture and newer brands which want to reach out to consumers, India too is catching up and the new format is being well received by both the rural-urban and urban dwellers in the country.

In the past as well, a lot of brands –both domestic and international—had trimmed their retail store sizes owing to limited space availability. However, this too has its own set of risks. While going for a small sized outlet, brands need to ensure their signature look and feel aren’t lost during floor space downsizing apart from considering the need to create a seamless, memorable in-store experience and displaying the right inventory for each location. Going forward, small format retail stores are all set to become the business model that retailers are going to bet on. While other business models including experiential, large formats still have their eminence, a considerable number of retailers/ brands are now ruminating about resizing their stores to smaller sizes for better return on their investments. The overall retail scenario is undergoing a transformation of sorts and the passing years will decide on what will work for the ultimate success.