Dollar Industries Limited reported a robust performance in the first quarter of FY ’26, driven by double-digit growth in both revenue and profit.

The company’s total income rose 19.5% year-on-year (YoY) to Rs. 399.79 crore (US $ 45.63 million) in Q1 FY ’26, compared to Rs. 334.43 crore (US $ 38.17 million) in the same quarter last year. Operating income grew at a similar pace, up 19.6% YoY to Rs. 399.13 crore (US $ 45.55 million). On a sequential basis, however, total income fell 27.4% from Rs. 550.91 crore (US $ 62.88 million) in Q4 FY ’25, reflecting seasonality in sales.

Gross profit for the quarter stood at Rs. 141.48 crore (US $ 16.15 million), marking a 19% YoY increase, with the gross profit margin holding steady at 35.4%. Operating EBITDA improved 20.4% YoY to Rs. 42.88 crore (US $ 4.89 million), with the margin inching up 8 basis points to 10.7%.

Net profit (PAT) jumped 39.3% YoY to Rs. 21.32 crore (US $ 2.43 million), translating to a PAT margin of 5.3%, up 76 basis points from last year. Earnings per share (EPS) came in at Rs. 3.76, also up 39.3% YoY.

For FY ’25, the company had reported total income of Rs. 1,715.81 crore (US $ 196 million) and a PAT of Rs. 91.04 crore (US $ 10.39 million), with an annual PAT margin of 5.3%.

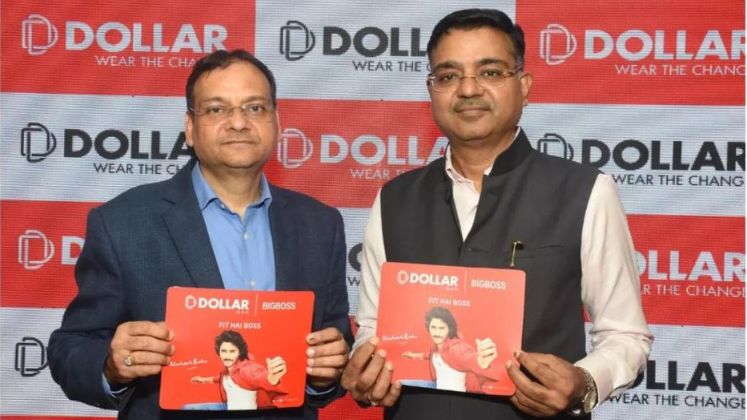

Commenting on the results, Vinod Kumar Gupta and Binay Kumar Gupta, Managing Directors of Dollar Industries Limited, highlighted the strong performance of the company’s modern trade, e-commerce, and quick commerce channels during the quarter. These channels delivered a 65.2% year-on-year growth in revenue and an 82.0% increase in volumes, contributing 12.2% to total operating revenue compared to 8.7% in Q1 FY ’25. Quick commerce alone accounted for 3.1% of the total. The Force NXT brand also registered impressive gains, with year-on-year growth of 23.0% in value and 17.5% in volume.

They noted that these results underscore the effectiveness of the company’s strategic focus on high-margin products and its growing presence in new-age distribution channels, adding that these initiatives will remain central to driving sustainable growth and profitability in the coming years.