The value fashion market tends to remain relatively unscathed during periods of economic downturn, as consumers find it practical to switch to budget-friendly fashion without giving up on style, argues Akash Agarwal, Whole-Time Director, V2 Retail, a value retail brand. Akash highlighted that the company’s focus on value-based offerings makes it easier for them to handle macroeconomic challenges with less impact. “Over the years, we’ve focused on bringing the latest trends to consumers at unbeatable prices, catering to a broad audience with a mix of men’s, women’s and children’s apparel,” he said.

The value apparel sector has also caught the attention of big retailers such as Trent’s Zudio, Reliance Retail’s Yousta, Aditya Birla Fashion & Retail Ltd.’s Style-Up and Shoppers Stop’s InTune.

India’s value retail market, excluding food and grocery, is expected to grow from US $ 111 billion in FY ’23 to US $ 170 billion by 2026, with a CAGR (compound annual growth rate) of 15 per cent from 2023 to 2026, as per Wazir Advisors. The rise in disposable incomes and rapid urbanisation is driving a shift from unorganised to branded retail. No wonder, value fashion now makes up 56 per cent of the entire apparel market.

V2 Retail reported a 61 per cent growth in revenue for the first half of FY ’25, reaching Rs.795 crore (US $ 95.6 million), compared to the same period last year. However, EBIDTA margin stood at 11.1 per cent for H1 of FY ’25 as compared to 11.2 per cent for H1 of FY ’24.

The company, which has 128 operations stores across 18 states, now plans to open 50 more stores this year, particularly in Tier-2 and Tier-3 cities such as Bhopal, Jaipur, Visakhapatnam, Gorakhpur and Jamshedpur.

“Our expansion will strengthen our presence in states like Uttar Pradesh, Bihar, Odisha and West Bengal, where we already have a significant customer base. Moreover, we are focusing on regions in Southern India such as Karnataka and Andhra Pradesh to capitalise on rising demand in these areas,” mentioned Akash.

Discussing the brand’s strategy for selecting new locations, Akash mentioned local fashion sensibilities are assessed to align product offerings with regional preferences. Spending power and demographics are studied to target areas with strong purchasing potential and a growing population. A detailed competition analysis helps identify market gaps and differentiation opportunities. The retailer also analyses additional factors like accessibility, infrastructure and footfall potential to ensure visibility and convenience for customers.

In an exclusive interview with Apparel Resources, Akash Agarwal shed light on the retailer’s strategies for pursuing growth amidst competition and improving the economic environment.

AR: V2 believes in offering both value and variety. However, there is a perception that ‘value’ implies low quality. What is your perspective on this?

AA: I beg to differ here because we strongly believe that value and quality can coexist. Here’s how we make it happen. Our focus is on sourcing the best fabrics and designs while maintaining competitive pricing. Our 55 per cent markup allows us to offer fashionable products at affordable rates, similar to brands like Shein, Revolve and Primark. We enforce quality control through rigorous vendor audits, thorough inspection of raw materials and continuous monitoring of production stages. Final products undergo strict testing for durability, stitching quality and colourfastness. Additionally, a customer feedback loop helps identify and correct recurring issues.

We also leverage our significant buying power to negotiate bulk discounts and preferential terms with suppliers. We even employ strategies like long-term partnerships, ensuring consistent orders and volume-based pricing agreements to secure lower costs.

AR: You offer products under the brand names – Godspeed, Herrlich, Glamora, Ebellia and Honey Brats. Could you tell us more about each brand and who they’re designed for?

AA: We are transitioning away from multiple private labels and moving towards a unified brand approach under the banner of ‘No Brand Only Fashion’ (NBOF). This change allows us to streamline our offerings, emphasise fashion over brand names and cater to a broader audience with simple, accessible fashion for men, women and children.

To evaluate the effectiveness of the NBOF strategy, we would track metrics such as customer acquisition rate, average transaction value and repeat purchase rate. Also, key indicators include footfall and online traffic growth, conversion rate and customer satisfaction scores. Sales performance metrics like revenue growth and profit margin will also be monitored to assess the strategy’s impact on engagement and sales over the next year.

AR: Making the most of every inch in-store is key for profitability. What are the top factors you consider when optimising store layout and space?

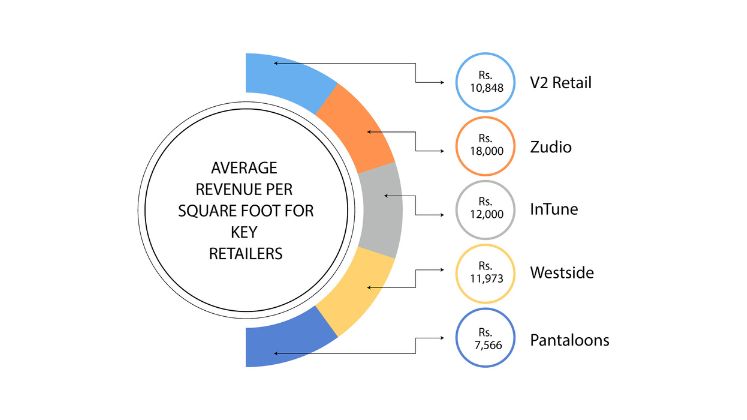

AA: Store sizes are optimised based on the demographics of the region. In Tier-2 and Tier-3 cities, we focus on ensuring that store layouts are functional and can handle high volumes of customers while keeping operational costs low. The average sales per square foot is Rs.904 per month and we constantly work to improve space utilisation.

For instance, we recently revamped store layouts by creating dedicated sections for high-demand categories and introducing modular shelving for flexible displays. These changes improved space utilisation and enhanced product visibility, increasing customer engagement. When redesigning, we consider factors like footfall patterns, product adjacency to encourage cross-selling and seasonal trends. Also, customer feedback and sales data drive layout decisions, ensuring the shopping experience aligns with evolving consumer preferences.

We also leverage heat maps and customer tracking systems to analyse customer flow and shopping behaviour, while giving special attention to staff training on upselling.

AR: What are the latest cutting-edge innovations or technologies you’ve implemented in your operations?

AA: We use advanced ERP systems and data analytics tools to optimise inventory. These tools leverage AI-based forecasting algorithms to predict demand patterns, considering factors like seasonality, regional trends and sales history. Real-time stock monitoring allows for automatic replenishments and reduces overstock or stockouts. Integrated POS systems provide instant sales insights,

enabling dynamic adjustments and efficient supply chain management to align inventory with customer demand seamlessly.

Furthermore, we track key metrics such as inventory turnover ratio, sell-through rate and stock-to-sales ratio. Additionally, days of inventory outstanding (DIO) and demand forecast accuracy are monitored to align stock levels with customer demand.

That’s not all! We are in the process of integrating a WhatsApp business system for automated vendor communication. This system would automate vendor communication by sending automated order updates, stock requirements and payment reminders directly to vendors. The system would enable quick sharing of purchase orders, delivery schedules and inventory reports through secure messaging.

This system integrates with our existing supply chain management tools through API integrations, enabling seamless data exchange between platforms. It syncs real-time order updates, stock levels and delivery schedules directly into V2’s ERP system. While initial customisation was needed to align messaging templates and automate triggers, compatibility challenges were minimal due to flexible APIs.

I’m also looking into technologies like RFID tracking to get real-time updates on our inventory and IoT sensors to monitor product conditions while they’re being shipped. We’re considering using blockchain too to make our supply chain more transparent and robotic process automation (RPA) to simplify repetitive tasks in inventory and order management.

| We are transitioning away from multiple private labels and moving towards a unified brand approach under the banner of ‘No Brand Only Fashion’ (NBOF). This change allows us to streamline our offerings, emphasise fashion over brand names and cater to a broader audience. |

AR: It’s reported that V2 Retail is also working on an omnichannel model where it will be using its stores as dark warehouses. Tell us more about it.

AA: Yes, we are developing an omnichannel model that leverages our stores as dark warehouses to enhance online order fulfilment. This strategy allows us to deliver orders faster by utilising nearby stores as distribution hubs, optimising inventory management and reducing shipping times.

Talking about its nitty-gritty, we plan to integrate the omnichannel model by centralising inventory data using a unified ERP system, making store stock visible to consumers online. Real-time inventory tracking through RFID and cloud-based systems will enable accurate stock updates across channels. Customers can check availability at local stores and choose options like same-day delivery.

We will implement this pilot program in Delhi-NCR and assess its impact by tracking key performance indicators (KPIs) such as order fulfilment rate, delivery time and customer satisfaction scores. Additional metrics include inventory accuracy, store-to-customer delivery efficiency and return rates. We will also monitor sales growth from online channels and cost per delivery. Success in these areas will determine readiness for a national rollout of the omnichannel model.

However, there are potential challenges we may face with the dark warehouse model, including inventory synchronisation, logistical complexities and maintaining operational efficiency during peak times. Our focus would also be on training staff on new fulfilment processes and optimising delivery routes.

AR: How do you view the current consumer sentiment?

AA: Current consumer sentiment in India remains largely positive, indicating a strong demand for goods and services. Even though there can be ups and downs because of factors like inflation, interest rates and global events, the overall feeling is that people are confident of the economy and ready to spend. This good sentiment is backed by signs like rising disposable incomes, increased consumer spending and a growing middle-class.

In terms of our business performance, we are seeing specific trends in our product categories. The fastest-growing category for us is men’s denim, which makes up about 6 per cent -6.5 per cent of our total revenue. Men’s T-shirts come in close behind, accounting for 5.5 per cent – 6 per cent. We expect to see a more balanced revenue spread across categories in the future. While menswear will likely stay strong, we also anticipate growth in women’s ethnicwear and kids’ apparel, driven by rising demand and changing fashion preferences in Tier-2 and Tier-3 cities.