The fusion of e-commerce and social networking, commonly referred to as ‘social commerce’, has brought about a revolutionary shift in the e-commerce landscape in recent years. This amalgamation has not only transformed the online shopping experience but has also granted businesses unprecedented access to the vast potential of social media platforms. From Facebook, Instagram, and TikTok to Pinterest and now WhatsApp, these platforms are creating fresh avenues for customer interaction and diversified revenue streams, marking a paradigm shift in the dynamics of online retail.

Rising Social Commerce and its impact on consumer behaviour

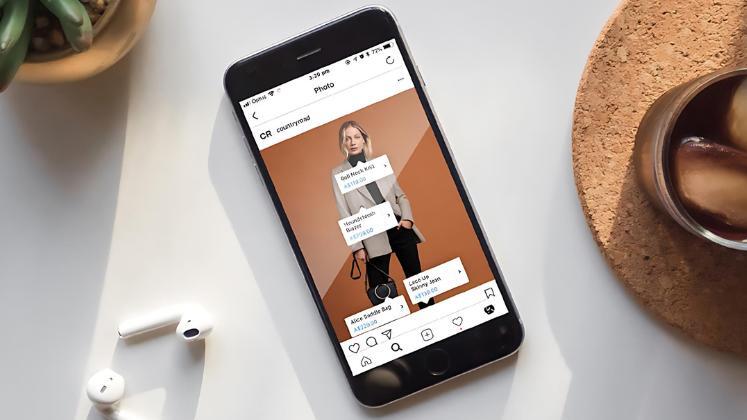

Just imagine browsing Instagram, seeing a perfect pair of shoes or a party dress, immediately adding them to cart and buying them with your preferred payment method… all without leaving the app! This is why almost all fashion e-commerce companies have

started looking for ways to make use of this potential to increase sales and brand awareness after realising the size and engagement of these platforms’ user bases.

WhatsApp Commerce in particular is gaining ground, thanks to its conversational approach that enables businesses to directly engage and interact with customers on the messaging app. With two billion users globally, the highest of which are in India (487 million), WhatsApp offers a large captive customer base for brands. In addition to apps and websites, WhatsApp has become an unmissable channel for brands that want to be closer to their customers.

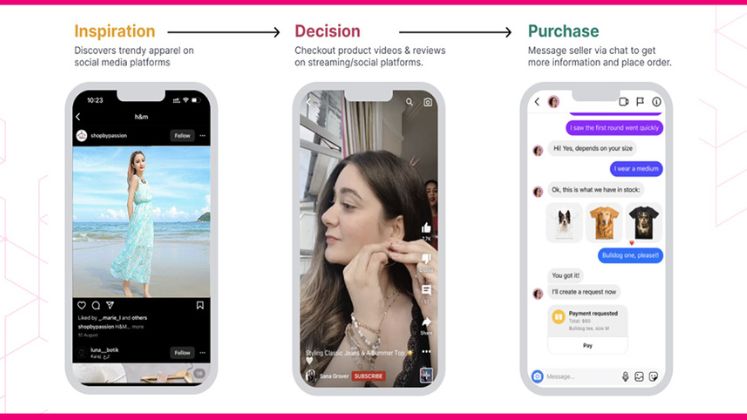

User-generated content, influencer marketing, in-app checkout, live shopping, shoppable posts and social referrals are just a few of the features and tactics that make up social commerce. Businesses may interact with customers directly, streamline the purchasing process and improve customer satisfaction by incorporating these features into social media platforms.

The Next Gen Social Commerce Playbook, a research study by Snapchat and Havas Media Network, examines how companies can effectively engage Millennials (aged 24–34) and Gen Z (aged 13–23) in the social commerce area. In India, 94 per cent of social media users have purchased clothing through social media. The report also underlines how important social media is for Indian customers’ buying experiences. It reveals that six out of ten Indian consumers find new brands and goods on social media and they also depend on it for product recommendations and reviews.

Another significant study demonstrated the role that virtual try-on capabilities have in increasing conversion rates, especially in India, where 79 per cent of respondents thought the feature was essential. These outcomes span a number of industries, including clothing. Augmented Reality is important in all retail verticals, but it’s especially important in the luxury market, as two out of three social media users acknowledge. Furthermore, a significant proportion of Indian luxury buyers—85 per cent—state that the availability of a virtual try-on function influences their decision to buy.

Customers may view product recommendations according to their preferences, hobbies and social networks, which enhances the relevance and fun of their purchasing experience. Recommendations from peers or influencers that they follow have a greater chance of being trusted by consumers rather than conventional advertising. Because of this change in customer behaviour, firms now need to reconsider their marketing plans and put more emphasis on developing real relationships with their target market.

What Social Commerce does better than traditional e-commerce

With a mobile phone and a cheap internet connection to go with it, social commerce has not only become easy but also important. It has a good number of benefits over traditional e-commerce.

Social commerce facilitates clients’ purchasing decisions by shortening the path from product discovery to purchase. Shoppable posts and in-app checkout options ease the purchasing process, lowering cart abandonment rates and increasing conversions.

| The Indian social commerce market size reached US $ 3.3 billion in 2022, according to IMARC Group, a leading market research company. Looking forward, IMARC Group expects the market to reach US $ 18.2 billion by 2028, exhibiting a growth rate (CAGR) of 32.7% during 2023-28. |

While scanning through their social media feeds, users can easily find new products, special deals and limited-edition items. This instantaneous product discovery promotes impulse purchases and increases brand visibility.

Through social commerce, marketers can use user information and preferences to target advertisements. Brands are able to provide recommendations for products, promotions and adverts that are specifically tailored to the interests of their target audience by examining the behaviour and interactions of their customers. Brands even have access to important data regarding interests, buying patterns and demographics of users. These insights help with trend identification, product offering optimisation and marketing strategy refinement for improved outcomes.

Indian brands adopting Social Commerce

Clothing retailer Bestseller India has announced its partnership with social commerce platform, Trell, to launch fashion brands Jack&Jones, Vero Moda and Only. Through this association, Trell aims to increase its offerings in the mass premium segment and strengthen its presence in the Indian fashion market.

Myntra, the online fashion retailer, announced its expedition into social commerce at scale. As part of its foray into social commerce, the company also launched M- Live, a first-of-its-kind interactive and real-time shopping experience for its customers.

Flipkart, the e-commerce brand, announced the launch of Shopsy, a separate platform for social commerce which enables people to start their online business without investment.

Meesho, a forerunner in social commerce in India, said that it enabled transactions for 14 crore customers on its platform with 80 per cent of orders coming from Tier-2 and beyond markets in 2023.

| According to data from Tidio, the global social commerce market size is US $ 958 billion with the size expected to grow to US $ 1.6 trillion in 2024. The highest number of social commerce buyers come from Thailand (88%), India (86%), UAE (86%) and China (84%). |

Ajio, a part of Reliance Retail, in November, announced the launch of AJIOGRAM, a D2C-focused content-driven interactive e-commerce platform to help Indian fashion start-ups. Some of the top brands exclusively available on AJIOGRAM include Urban Monkey, Supervek, Quirksmith, KRÁ Life, Creatures of Habit, Cecil, Truser, Fancypants, MIDNIGHT ANGELS BY PC, Monks of Method, Crafts and Glory, amongst others. Ajio said it will provide dedicated support to D2C brands to help them scale and achieve their strategic revenue growth. AJIOGRAM will also provide long-term, brand-building support through 360-degree marketing to fuel growth for brands. This includes seamless integration with Ajio’s influencer ecosystem, Reliance-owned media properties and offline events, along with co-planning support to help brands build margins and accelerate their revenue growth.