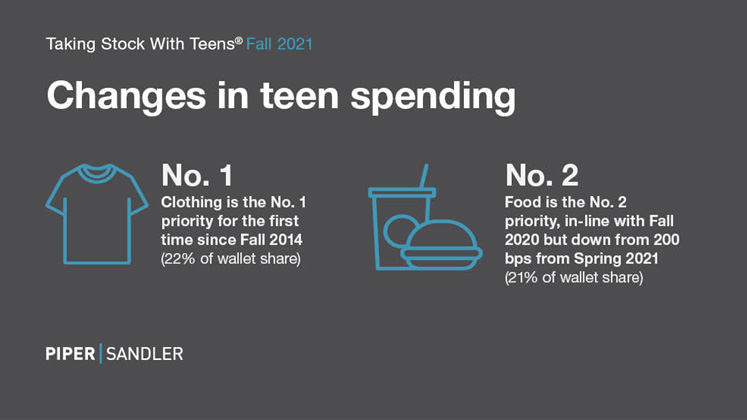

Piper Sandler Companies, a leading investment bank, has completed its 41st semi-annual Taking Stock With Teens® survey in partnership with DECA. This survey highlights discretionary spending trends and brand preferences from 7,000 teens across 47 US states with an average age of 16.1 years. Generation Z, which contributes approximately US $ 830 billion to US retail sales annually, represents an influential consumer group for whom wallet size and allocation provide a proxy for category interest.

The survey saw female-led spending recovery with upticks in spending on clothing, handbags and skincare in particular. Within apparel, athletics is still the dominant trend with Nike & Lululemon taking new highs and Under Armour seeing improved mindshare. Simultaneously, we are seeing a revival of the 1990s fashion trend flannel shirts, baggy pants, mom jeans and eclectic hair trends all in vogue.

Looking closely at the conscious generation

GenZ is a conscious generation as teens this spring cite racial equality and the environment as their top-two social issues, the survey highlighted. It was also seen that ‘thrifting’ emerged as a strong trend as thinking second-hand is becoming second nature to teens. In fact, 47 per cent of teens have purchased and 55 per cent have sold second-hand. In the wake of COVID-19 and given these consumers are digitally-native, the report was also able to track that online adoption was at its highest ever this Spring. Snapchat and TikTok are the top two social media platforms. While Amazon remains the No. 1 website, there has been a rise in female-centric platforms like SHEIN, Revolve and Princess Polly.

Sharing a similar sentiment, Sreyashi Raka Das, Founder, SRD (Sreyashi Raka Das) mentioned, “Teens have always been a great support for our label since the very beginning. Being a sustainable, non-judgmental, lgbtq+ friendly line, our clothes are been loved and appreciated by teens. They are very environment-conscious and are really trying to follow the path of conscious fashion. They are more sensitive about reading / knowing the story behind fashion. They try to see why we are making this particular dress, the motif and idea behind it. That’s something interesting. Also our clothes are pocket-friendly, which is one of the reasons why they enjoy getting our clothes (This is because most of them are depending on pocket money or are partially dependent on it for spends).”

Also Read: Shapewear innovation is making a mark with customers

Raj Rana, CEO & Co-Founder at Sexy Beast when talking about the Indian teens mentions, “I believe apparel spending for and by teens has a lot to do with new-age platforms such as Instagram, Snapchat and a plethora of social media copycats that have sprung up in India. In my own experience, I have an eight-year-old going on 18 that is influenced by what she sees around her – in real life and the little media that filters through to her. Interesting fact – Gen Z is the first generation not to have grown up without mobile phones! As per industry reports, teens spend a whopping 4.5 hours on average, on their devices, daily; brands now have the ease of tailor-made marketing solutions and targeting, thanks to social media platforms. Social media is one of the top mediums for product discovery (Instagram being #1), and when you add in the clever algorithms platforms provide brands, you can connect the dots and realise why Gen Z is the fastest-growing segment for fashion retailers, across the world and in India”.

Recent reports show that up to 70 per cent of Gen Zs who are interacting with brands are significantly more likely to purchase. Chinese ultra-fast-retailer Shein’s global marketing strategy of a persistent and ubiquitous presence across all social media is interesting to note here. The pandemic situation drove Gen Z‘s online spending even further, so it should come as no surprise that this segment is driving fashion spends, and hence being talked about so much. Raj further asserts, “Our designs kind of speak for themselves when you consider who we are targeting, but the focus for us is a much wider TG that includes millennials too. Approximately 45 per cent of our audience is made up of Gen Zs. Our product pricing and positioning are targeting the ‘affordable luxury’ umbrella. We feel that teens are yearning to express themselves more than ever given what the world and India have just been through. So why not help them in pursuit of their passion, career and life goals. Our brand, product line and positioning do just this!”

What’s trending

When asked what will drive the teens to spend more, Raj says, “As long as the Instagram Reels and other Social Media platforms continue to weave their spell in the minds of teens, I think you’ll see a larger chunk of their disposable income going towards buying apparel online. We’ve been part of a gradual shift from a saving economy to a consumption economy, with the proliferation of media and online being a big reason for that. Whether it’s economic independence, a full piggy bank or convincing parents as the decision-makers for the purchase of a Sexy Beast Lounge Boxer Short, the teens will find a way. With credit cards being thrown at teens and no-cost EMI options such as ZestMoney and Sezzle, I think finding money to spend on apparel online is not really too difficult”.

“I think both savings and easy payment options work for us. The second part works more in case of younger teens (from 13-16). Also I have seen positive response from their parents as well. And definitely economic dependency is helping them more. I have seen people buying my clothes from all the classes (from a daughter of a local nurse to quite popular actress). I think that’s a win. I do not see people like targets, which means I don’t have any specific compartmentalised buyer group. I try to make clothes which can approach every section of the society. Having a comfortable price range helps in this case,” Sreyashi adds.

In terms of Sexy Beast fulfilling the needs of the teens, Raj is quick to mention, “We have been flirting with a few more product variations. There really is no limit to how much you can enhance or segment a product. Fortunately for the consumer, we have already gone the extra mile in terms of an enhanced product. We’re constantly acting on feedback, looking for improvements, and market trends to make our product more relevant for all. In terms of product development, we are BIG on R&D. I must have gone through ~8 different fittings on the Lounge Boxers alone. There are still improvements in the pipeline – a hook, enhanced elastic, a drawcord and more. Whether we segment these into new product ranges with higher pricing or enhance the current range, is still being decided.”