A lot has been said in recent days about how Indian apparel exporters have good orders now. Thanks to the prolific festive season, the Indian domestic market is growing steadily. Overall sentiments are picking up after almost one-and-a-half years. Q2 results of most of the textile and apparel companies confirm this positivity of sentiments. Physical fairs have also started to take place and good footfall shows that industry professionals are now moving out for new deals. But at the same time, price pressure is also higher than ever as across the value chain, prices have increased. Apparel Resources explores how in this enthusiastic as well as challenging scenario, yarn and fabric manufacturing companies are growing, what is their strategy to encash this optimism and how they are managing a hike in cotton and yarn price.

The most interesting point is that majority of yarn and fabric companies are optimistic about the market condition and despite the high costing challenge, they are not disheartened and are continuing with their product development. Few companies claim that they have not increased the price and observed the cost while few have changed their strategies and are looking at their overall profitability not just a certain percentage of margin in every product/ every order and every client. The majority of the companies with whom Apparel Resources discussed, believe that sooner there shall be a correction in price and the market will return to normalcy.

Market is bullish

BP Nalawade, AVP- Marketing (Knits), Birla Cellulose (Grasim Industries), Mumbai agrees that the market is picking up and the industry is coming forward for new development. “Market sentiments are very high and everything is bullish. I feel many yarn companies are now overbooked. I hope things should continue like that.” He further added that a big chunk of the industry (especially in North India) are looking for speciality products like modal, micro modal, especially for tees and innerwear. Sustainable spun dyed yarns are also attracting clients.

Rajesh Mittal, Director, Cedaar Textile, Bengaluru also echoes a similar opinion as he says that the overall textile industry is better now and a lot of demand is coming for value-added and sustainable products. “Our company is also focusing to expand products in the same way. We are using yarn made with PET bottles, we are following Global Recycle Standard (GRS) and offering organic products also.” The company is having its production unit in Ahmedgarh, Punjab.

Strategies to overcome high costing

Though overall costing across the products and textile industry is high, still the situation is little different for product to product, company to company. Like in case of recycled polyester, costing has not increased much while for the acrylic segment, overall things are very difficult.

Rishu Malhotra, Senior Marketing Manager, Indian Acrylics Ltd, Chandigarh is strongly of the view that the current market conditions are the toughest period in terms of economy. “In the acrylic segment, which is mostly for the middle-class segment, we have hardly seen such challenge before. People coming to us are asking for polyester acrylic blends or such blends where we can optimise the cost. This is where feasibility has to be seen. This season, margin doesn’t exist for the acrylic segment and this is just the cycle to move on. Whatever acceptability is there, it is for cotton, and not acrylic so far.”

She further added that the company is doing some amalgamation with newer fibres like viscose and later on it will have modal in the pipeline. The company claims to be the largest acrylic supplier in India and it has its own fibre plant in collaboration with DuPont. It is also in the process to introduce antifungal and antibacterial fibres.

Rajesh Mittal believes that inflation has increased but prices in textiles have not increased much. He stated, “And I must say that when focus is on recycling, irrespective of a few products, the price doesn’t increase much, there is 2 per cent to 4 per cent hike in such products especially for recycled polyester which is acceptable.”

Some companies claim that they have not increased the price. BP Nalawade said, “Our price is very stable, whatever change is there in cotton, other raw materials or high fuel price, we have not changed our price. Yes, every company is under pressure on the price front but we are not putting any burden on our customers and we ourselves are bearing the pressure. Looking at the escalation of the prices of various things, there may be some revision.”

Enthusiastic market conditions are also motivating companies to focus more on product development (PD) and they are doing this despite the fact that PD has its own huge cost. At the same time, there are such kind of developments too which help to develop cost-effective kind of products.

KG Denim Limited, Coimbatore is also getting huge orders of cotton viscose fabric and the company has also developed blends like cotton nylon, cotton linen, cotton hemp and Tencel blends. Deeper shades in indigo have higher costing, so tinting effects help to get a similar impression.

Sonesh D Sharma, AGM (Marketing) of the company said, “Value for money concept is there always and despite all the pressure, our PD is continuing. With the positive condition and good festive season, the market and overall things shall move in a good direction.” He further added that in the next 3 to 4 months, the mismatch of demand and supply will not be there and it will help the market to be stable.

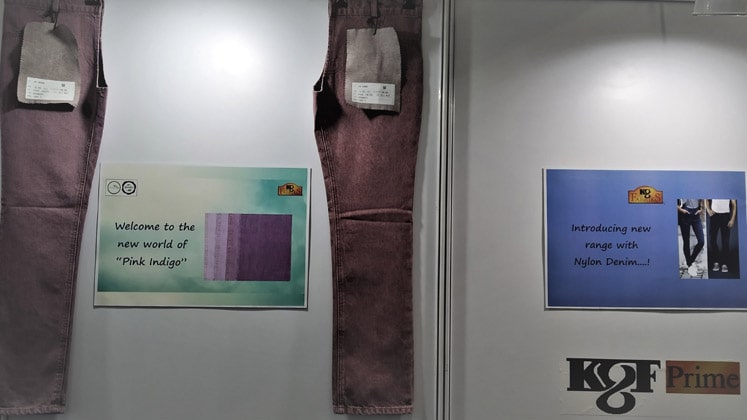

Similarly KG Fabriks Limited, Coimbatore has recently come up with pink Indigo and nylon denim mainly. Pink indigo is the company’s in-house re-engineered development. It is yarn-dyed and has very good fastness properties.

“Our management very much supports PD and we believe that high costing is for the current situation and should not be there for long-term but PD is for long-term and is a consistent process,” said Karthikeyan M and Nithyanandhan N, KG Fabriks Limited, Coimbatore. The company is well-known for its sustainable denim fabric manufacturing.

The price of organic cotton-based yarn and fabric has increased significantly and it is one of the areas where most of the stakeholders are helpless. But the good thing is that majority of end customers understand this and pay also.