Enter a fashion retail store and there will be endless options of trendy ensembles, but for straight sizes ranging from 0-12. Plus sizes, which generally fall between 14 and 34, are not readily available even as there is a huge market waiting to be tapped. The plus size market in India is estimated to have a share of 12 per cent of the overall fashion segment and is projected to grow at 25 per cent per annum for the next 5 years. However, of late, the retail industry has realised the potential of this segment and is taking steps to address the unmet needs. A number of retail firms across the country and even abroad are adapting a playbook for rolling out plus-sized merchandise that mirrors their product lines. Plus size consumers constitute about 67 per cent of the population, generating around US $ 21 billion in annual sales, confirmed Business Insider.

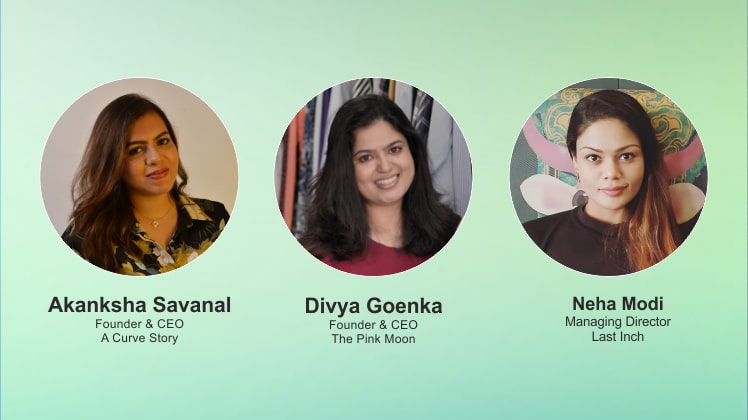

With the industry starting to take this segment seriously, even start-ups have come out to venture into this market because of the mass consumer base it has. A large number of Indian women wear clothing above XL size and they sure want to dress fashionably instead of sporting baggy kurtas and men’s T-shirts. Few of these start-ups which cater to only this segment include The Pink Moon, Last Inch, A Curve Story, and Lurap among others.

“For the longest time, plus size clothing was a relatively small and neglected category in the fashion landscape. There were very few stylish options and almost everything on offer was baggy and shapeless. For most, the only option was to go to a tailor. It is sad but true that most brands focus on fashion as that which will cater to the tall and skinny woman,” asserts Divya Goenka, Founder & CEO, The Pink Moon.

What’s ballooning this segment?

Big is beautiful and it took long for the industry to realise this. Until very recently, few retail brands had been making plus size clothing, which has changed for good now. This segment is estimated to have US $ 5-6 billion worth of market by this year in the overall fashion industry, and with the increasing number of brands as well as dedicated start-ups in the segment, this is certainly going to grow in the coming years. Neha Modi, Managing Director, Last Inch, maintains, “In today’s scenario there are so many emerging brands/collections especially in plus size e-commerce sector. The consumer now has multiple options to choose from based on desire, styling, pricing, fittings, return policies, etc. Plus size clothing has become a part of womenswear clothing segment now, with no major distinguishes except the sizes. The per capita is obviously increasing with time in this sector due to the awareness and huge variety which was not there previously. Also, the Indian woman is now opening up to experimenting with clothing, which was missing earlier.” A plenty of attention to the plus size segment is coming through discussions on body positivity as well as models not confined by their body sizes on social media platforms.

While the ’90s had a major contribution of the traditional tailors and boutiques when it came to plus size clothing, the organised retail sector only recently took the initiative to invest in the sector. With this, shopping behaviour of the customer base in the segment too has changed drastically over the years.

As trendy as can be

Clothes designed for women in double-digit sizes rarely have the level of design or quality of regular sizes. It is now the duty of these start-ups exploring the category to bring attention to style, trend, fit, and fabric – all at the same time, besides emerging as an on-trend label which is size-agnostic. And these brands are ensuring that garments not only flatter all body types, but also seamlessly transition time, lifestyle, and season. Akanksha Savanal, Founder & CEO, A Curve Story, agrees, “Our brand is backed by highly creative minds for the design process which works well for generating products that our customers would love. As a brand, A Curve Story does not believe in following trends blindly. We like to tweak and work around classics. We had dedicated almost 16-18 months of our time in understanding the market and its requirements before we officially launched. This information has come in handy now as we create different line-ups for the brand. Surveys and feedback are the backbone of our brand.”

It was during her stint as a Bollywood stylist when Akanksha realised there is a huge vacuum for fashion options available in curve segment. A Curve Story stocks a wide size range, starting from UK 8 to UK 30 and is also open to creating a size outside of this range if a customer asks for it. Others like The Pink Moon and Last Inch follow trend forecasts and trends reports in terms of colour, cuts, fits, embellishments, and adapt them for the Indian plus size customer. While the three start-ups in the segment believe that there is an innate need for making the plus size clothing trendy as well as comfortable, the fastest moving category for The Pink Moon is bottomwear (ranging from well-fitted jeans, formal pants to jeggings, track pants and even skirts), while T-shirts and tops are for A Curve Story, and kurtas and suit sets best serve for Last Inch.

Even as these players in the segment are all set and equipped to rule the segment, the competition still remains a tough one with a number of established brands foraying in the category, including the likes of aLL by Future, Gia by Westside, and H&M+ among others. However, the start-ups are confident of their fresher approach to the design process as also the quality being offered. Divya Goenka avers, “It’s a combination of quality, consistency, and value for money that we aim to deliver. We have grown month on month, despite our competitors who are better known than us and have lower price points compared to us. Our prices can be construed as higher than these big brands, because we spend a lot of time understanding and researching exactly what the plus size customer wants. This research will be visible in our choice of fabrics, the stitching, the accessories used such as the elastic, the buttons, the zippers, and even the threads.” Start-ups could take longer to be in the green zone given the economic situation, but it’s a steady growth graph if the strategy is rightly in place.

Back-end processes

Plus size apparel needs specific product knowledge and skills for category development. A plus size clothing expert confirmed that besides the stigma around plus sizes, or the belief that this is still for a minority of women, there are also some pragmatic and logistical challenges facing this segment. In this scenario, adequate attention to the manufacturing process is a must and today’s start-ups have well taken the control in their hands and ensure offering the same to their consumer base. Neha Modi points out, “We started in 2014 with outsourcing. But with time and increasing demand, we had to start our own production house. We have our in-house manufacturing and designing team. Manufacturing plus size clothing is not everyone’s cup of tea, and it requires some specialisation in the areas where the standard grading norms of body measurements change as per increased size. The sizes go as big as 64 inches around the chest or 74 inches around the hip, which cannot be handled by a pattern master or tailor, if they haven’t worked on standards of big sizes. Our USP lies in understanding the grading it requires for plus size bodies to give perfect fitting. This is one big reason that in the past few years, we have started exporting plus size clothing around the world.” These bootstrapped start-ups in the segment give due attention to the manufacturing intricacies and do most of their product planning in-house in order to offer standard quality merchandise.

Whilst manufacturing these specialised merchandise is one challenge, competition, trained designers, customer acquisition, etc. constitute the next set of obstacles for the start-ups in the segment. Akanksha Savanal enlightens, “One of the factors that puts a lot of pressure on companies like us is the pricing, because there are plenty of low quality products being manufactured in manufacturing hubs. As a more thoughtful design house, we incur higher costs at every level – be it design, fabric, or manufacturing. Today, the average customer makes the purchase choice based on just the photograph of the product and the price. There isn’t a lot of awareness in terms of fabric and stitching quality, especially when it comes to everyday clothing. The second is lack of formal training of designers, pattern makers and tailors. Countries like China, Sri Lanka, and Bangladesh are far ahead of us due to strong vocational training institutes. It is often hard to find talent with strong technical skills who are also up to date with the latest fashion trends.”

A big business or not?

Contrary to the common perception, plus size segment has had its share of market reach in Tier-2 and Tier-3 towns as well. Retailing through online channels, it has come as a blessing for these start-ups to experience a wide reach to towns across Tier-1, Tier-2 and Tier-3 regions. Neha Modi expresses, “We get a huge amount of orders from Tier-2 and Tier-3 regions. Penetrating deeper in these regions provide us with new relevant customers, who are still in search of readymade plus size clothing in those areas. They mainly still rely on Indian boutiques. Being an e-commerce platform, we have an upper hand to reach those customers quicker than bricks-and-mortar models.”

While the outbreak of the global pandemic caused by COVID-19 has had its impact on the overall fashion industry, especially the start-up segment, it has surely pushed consumers towards online platforms, which is certainly good news for these start-ups. Besides, consumers are now focusing on quality more than ever, and brands or start-ups offering quality are sure of gaining the business back in due course of time. For now, start-ups have agreed to the fact that ‘perseverance is the key’ for any segment. As for the plus size market, the opportunity is huge, and even as it has come a long way, body sizes are still diversifying, and the segment is open to have more brands offering quality, trendy clothing for the curvy women.