Similar to apparels, China has held a long-standing supremacy in toy manufacturing as well. It is estimated by IBISWorld that China’s toy manufacturing industry is worth US $ 42.40 billion till 2020 which is growing at over 3 per cent CAGR. The major chunk of this value is contributed by soft toys which is estimated to be valued at US $ 20-25 billion. However what’s been troubling China’s export in toys is the fact that the country has been accused of not using sustainable materials to produce soft toys and these toys are made largely of polyester-based textiles.

That’s where the newcomers in toy manufacturing industry need to focus on and explore opportunities where China is lacking. Fetching even 1 per cent of China’s share in textile toys may generate a gigantic revenue graph for the manufacturing industry outside China. But, to fetch even slightest of values, one needs to set up a factory that outclasses China in every area – pricing, quality, sustainability, technology and system intregation, along with pin-pointed market strategies to target end-consumers. This is what even PM Narendra Modi emphasised on during one of his recent radio programmes ‘Mann Ki Baat’ on 29th August where he commented, “Today’s youth is focusing on toy manufacturing in India itself and contributing towards developing this industry in the country.”

One of such early joiners in the toy manufacturing sector in India is Noida-based Avanti Overseas Pvt. Ltd. that has realised that textile toy manufacturing should be done in more integrated manner and in a sustainable way to grab the space. Raghav Modi, Managing Director of Avanti Overseas visited China and learned what he NEED NOT to do in his factory here in India. He and his team did a pilot in their Panipat (Haryana) unit before setting up a factory in Noida and got desired results. The Noida factory is spread over 63,000 sq. ft. and became operational only this year in January.

The biggest challenge Indian manufacturers who are exploring space in textile toy category are facing right now is to make customers believe that India can do it. Customers are already there in the global market but the Indian manufacturing industry needs to leave an impression that not only they can deliver, but they can deliver quality and sustainable goods in competitive prices. And, to much delight of the industry, Avanti Overseas is setting early benchmarks in textile toy manufacturing.

Raghav stated, “Once that is done, I don’t think we can be stopped. We have some customers who are buying and selling 6 million pieces per month all of which is currently being sourced out of China! If we are able to convince them that from the day of order placement to dispatching it on port takes less than 70 days, we can do it, we could see a significant chunk of this come our way. Of course it all sounds much easier than it is but the market potential is massive.”

He asserted further, “Added to this, there is a massive diversification drive where customers are looking to have an alternate soucing place outside of China as the dependency is not something most retailers are comfortable with anymore. The pandemic has actually proved that multi-country sourcing is the only way to remain ahead. We are seeing a large number of buyers approaching us for textile toys those who probably never thought of sourcing from India but are now willing to give it a go.”

Producing around 90 per cent of its products for the export market, Avanti has also launched its own sustainable toy brand RESPLOOT and has distribution in 10 countries including Scandinavian countries (Finland, Sweden and Norway), France, Belgium, UK, Italy, Canada, USA, and India, while it is in touch with buyers from Japan and Australia as well. Hamleys – owned by Reliance Retail – is one of the first domestic brands to tie up with Avanti for a toy line, while it is one of the largest suppliers for pet bedding to Heads Up For Tails (HUFT) in India which is a renowned online platform for pets.

Circularity is not just on papers; Avanti works on being ‘sustainable’ till the product reaches to consumers…

Avanti wanted to have a competitive advantage in a different way, hence it went on to create something that makes sense from a value-proposition point of view and using materials that are indegenous. It never believed in going for a model where it needed to import material, process it here and send it back to buyers. Avanti then carved a niche for itself as it started using 100 per cent sustainable materials that are generated organically or completely recycled. Raghav opined that until now, toys manufacturing was not efficient in India due to the cost of production and lack of technology used. Moreover, all the toys were made with materials made in China mostly, so any producer would have to rely on imports.

Avanti has looked at three product categories in textile toys – 1) Made from Natural and Organic fabrics; 2) Made from Recycled Fabrics (extracted from PET bottles); 3) And, from blended fabrics such as hemp, jute, blends of cotton and hemp etc. As of yet, the company is purchasing recycled yarns from certified suppliers and getting it weaved from established weavers in Panipat, but since its scale is exponentially growing, the plans of setting up an in-house recycling unit are already underway.

“If you notice, we have also gone one extra mile to ensure we are sustainable in true sense. Squeakers inside the toys typically are made of plastic, however in our toys, we have done innovations to come up with Squeakers made of latex and this is rarely done by others. Even our packaging is extracted from recycled material,” shared Raghav.

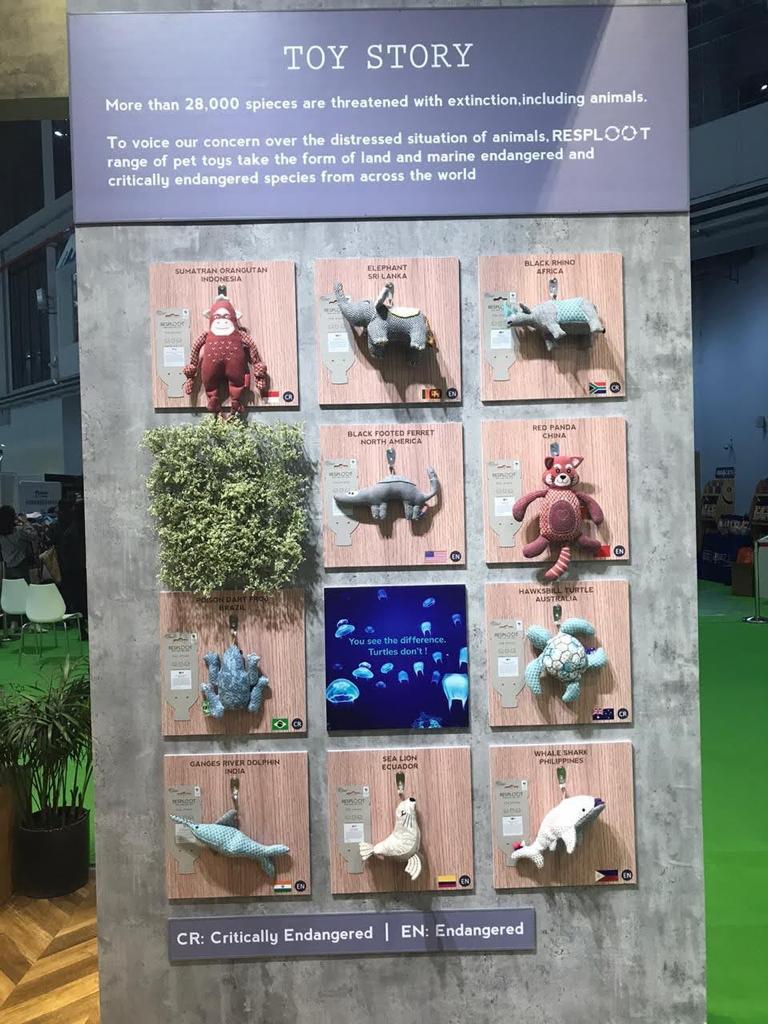

Not just from material procurement side, Avanti has made sure to become a responsible company that contributes towards planet conservation too. One of their product lines – under Avanti’s own brand RESPLOOT – is based on endangered animals and is all about educating consumers about the planet and animals. Currently, more than 32,000 species are officially threatened by extinction, which is roughly one third of all assessed species in a survey conducted by The International Union for the Conservation of Nature.

S. No. |

Endangered Animal (Product in RESPLOOT Toy Line) |

Origin Country/Continent |

PET Bottles Recycled to Produce Required Fibre |

| 1 | The Whale Shark | Philippines | 7 |

| 2 | The Orangutan | Indonesia | 6 |

| 3 | The Hawsbill Turtle | Australia | 7 |

| 4 | The Red Panda | China | 8 |

| 5 | The Ganges River Dolphin | India | 6 |

| 6 | The Galapagos Sea Lion | Ecuador | 6 |

| 7 | The Poison Dart Frog | Brazil | 6 |

| 8 | The Black-Footed Ferret | North America | 6 |

| 9 | The Black Rhino | Eastern and Southern America | 8 |

| 10 | The Asian Elephant | Sri Lanka | 8 |

| 11 | The Koala | Australia | 6 |

| 12 | The Yellow-Eyed Penguin | New Zealand | 7 |

| 13 | The European Mink | France | 5 |

| 14 | The Vancouver Island Marmot | Canada | 5 |

| 15 | The Bowmouth Guitarfish | Japan | 5 |

| 16 | The Wolverine | Finland | 6 |

“To voice our concern over the dire situation in wildlife diversity, RESPLOOT’s range of pet toys represents a variety of critically endangered species from across the world,” informed Raghav. On these toys, a message is clearly given – the country where these endangered animals have come from, why they are called endangered, are they critically endangered or just endangered, etc. All these animals are part of the red list that WWF publishes worldwide and here Avanti is educating end-consumers too on a sustainable front.

“We have tied up with WWF India where we are paying a certain amount back to them towards conservation of the planet. So, circularity for Avanti seems to be not just in talks but on ground. There is a fundamental reason as to why we have gone ahead and done a lot more than just create a toy!,” commented Raghav.

Technology is assisting Avanti in its endeavours to be a frontrunner in toy manufacturing…

Avanti has carved a niche in the market and and has been able to snatch a small share from the Chinese toy export market. Without technology advancements, it was impossible for the factory to compete on a level-playing field. And, in order to get on that level-playing field, technology integration to business approach is a must which is what Avanti did while setting up a state-of-the-art factory.

According to Raghav, a lot of Chinese factories still outsource embroidery to jobworkers but Avanti has these value-addition processes in-house. The factory ensures that each one of the factory areas works complementary to each other so they have capacity utilisation and capacity planning based on each individual area which could service the entire factory together.

There are two sewing floors – one each for toy and pet bedding manufacturing. A total number of 250 high-end Digital Feed and UBT machines of SIRUBA have been installed that can produce around 6,000 toys and 2,000 beddings per day. SPIs and stitch programs for complex joints in toys have been fed in the digital system of SIRUBA by the in-house maintenance team and the operator is trained on those systems that makes the stitching process easier. “We are skilling the apparel sewing operators and working on a very clinical skill matrix test to ensure the tailors meet our requirements. This is also why we have decided to work on a complete employment model where we are recruiting and training is a part of the overall process,” shared Raghav.

Apart from this, the sampling unit of the factory consists of 30 latest Jack machines where exlcusive designs made by an expert design team led by Devika Modi, Head of Design & Development and Marketing of Avanti Overseas are worked upon!

Every textile toy has been given an OB according to which stitching takes place and a toy shell is formed, under the guidance of an IE and Production team. After stitching, the toy shell goes for fibre filling on a customised machine where an operator fills fibres in merely some seconds, post which the toy is manually weighed by operators in the weighing area. 70 per cent of filled toys are weighed accurately, while 30 per cent of toys are either sent to add fibre as per standard weight or need to be made a bit lighter.

Once weight is done, the toys are sent to the ‘turpai’ area where female workers apply three hand stitches on the opening of the toy shell to close it. This process is done according to assigned SAM and is monitored by an IE on an hourly basis. The entire process – stitching, filling, weighing, hand stitching, finishing and packing – is an online process on the same floor that adds an advantage for the team to achieve desired quality and productivity. What’s noteworthy is that DHU (Defect per Hundred Unit) rate is quite low on the shopfloor as they never cross 0.85 per cent in any textile toy order till date.

Since the inception of Avanti Overseas, Nimish, Dave, Founder, The Idea Smith – a renowned manufacturing business consultant – has been associated to ensure correct layout, capacity planning, team training and efficiency increment. The factory is currently running at around 65 per cent -70 per cent efficiency across departments, as mentioned by Nimish during Team Apparel Resources’ visit to Avanti, but IE and Production teams are working to take it to 85 per cent by the end of this year as a big order of 400,000 toy pieces among others is being negotiated in which efficiency can be increased.

As far as value-addition is concerned, the state-of-the-art embroidery unit does have 6 x27 multi-head machines provided by AURA that can process around 7,000 toys’ panels a day. The outer shells of toys are cut on 6 x 2 head laser cutting machines that are studded with cameras. If two shifts are being run, 12,000 toys’ panels (5,800-6,000 toys per shift) can be cut on these laser cutting machines.

On the pet bedding production floor, fibre processing unit is studded with 2 processing machines and 3 Indian-made filling machines installed by Multipro for filling operation. “The fabric and toy bedding material is still being cut by hand cutters but as the factory is building capacity, auto-cutters have already been planned…A set-up of a design studio is also under process along with capacity expansion that will help make product development process more advanced and automated,” shared Nimish.

What’s next for India and Avanti in textile toy category?

Toys were somewhat under the radar as they are not a part of the fast fashion world where India scores big due to its design. With the changed sentiment in the market, easier access to technology, availability of materials, a shift towards alternates more in line with sustainability as well as India producers working with plush materials, toy manufacturing has now become very relevant. Moreover, the Chinese producers are facing huge issues due to the salaries which are much higher and, if India can match the efficiencies, the country would be able to negate the China advantage to a great degree. “Like I said, though at the start India doesn’t need much and only 2-5 per cent of shift of business of toys from China to India could be billions of dollars,” mentioned Raghav.

As Raghav believes that Avanti wants to be a part of journey, not the destination, by the end of this year, the company is targeting revenue generation of around US $ 15-20 million as it has abundant orders in hand till the 4th quarter. “We have a capacity of catering to around US $ 1 million worth of orders per month in textile toys, while we can do US $ 500,000 worth of pet bedding products a month. We aim higher and are expecting 15 per cent annual growth once we reach our targeted revenues this year,” concluded Raghav.