In the business world, it’s rare for the hunter to become the hunted. But that’s exactly what unfolded for Gerber and Lectra – the company, once stalking Lectra, is now the one being acquired. This twist proves that relentless innovation is what keeps you ahead and on top.

We caught up with Daniel Harari, CEO, Lectra, who’s been leading the company for almost 35 years. So, how has Lectra managed to thrive in such a competitive industry for so long? According to Daniel, growth isn’t just about what you do internally—it’s about seizing opportunities beyond your own walls. When it comes to acquisitions, Lectra doesn’t settle for anything except the best. For one deal, the Paris-based company reviewed nearly 300 companies before finding the perfect match that fits its vision and goals.

And while Lectra’s cutters sell for double the price of most competitors, Daniel is unapologetic about sticking to quality over chasing lower price points. “For smaller companies that only need one cutter, we can’t downgrade our product to match that price point because our technology is too advanced and sophisticated. But for mid-sized companies that need two or three cutters, that’s where we become a much better choice. Once you compare throughput, efficiency and cost per garment, our system is more economical in the long run,” mentioned Daniel.

Daniel also spoke about how Lectra is driving Industry 4.0 forward and continuing to lead transformation in the industry by expanding the fashion value chain with new SaaS solutions.

Lectra, which reported total revenue of € 478 million (about US $ 500 million) in 2023, sees huge potential in India, even though it currently contributes just 3 per cent of total revenue. With 30 per cent growth in the Indian market in 2024 compared to 2023, Daniel is gung-ho about India’s future. “I believe Indian manufacturers are beginning to adopt agile production.” He also discussed how Lectra is addressing greenwashing in the industry. Here are the edited excerpts.

AR: Over your 35-year journey with Lectra, you’ve witnessed many changes in technology. What are the top three game-changing technological innovations you think have redefined the way the apparel industry operates?

Daniel: Over the years, I’ve witnessed countless technological changes, but if I had to narrow it down, the first big shift was the introduction of PLM (Product Lifecycle Management). When it was first introduced, it felt like a big deal, but two out of three PLM projects failed in the past. Why? Because most of those systems were built for other industries, not fashion. And fashion isn’t like anything else—it’s about speed, creativity and constantly launching new products. In other industries, you have fewer products and much longer development timelines. Plus, they’re process-driven. But fashion? It’s driven by design, imagination and flexibility. That’s why the older PLM systems didn’t really work.

That said, I believe PLM has finally matured in recent years. Today’s PLM systems are revolutionary—they’re tailor-made for the fashion world and have the flexibility we’ve always needed. The second big change, in my opinion, is sustainability. It’s a massive topic and we’ve seen a lot of exciting ideas coming from start-ups. But if I’m being real, it’s still a bit of a mess. No one’s cracked the code yet, though I believe we’re making strides with innovations like TextileGenesis for traceability. There’s a long way to go, but the seeds of change are definitely there.

The third breakthrough—and this one is close to my heart—is what we introduced just a few months ago: Valia Fashion. My team calls it the most important technological advancement in the last 10 years. And I agree. I even believe it is the most important technological advancement ever. Valia Fashion is a SaaS platform that simplifies the entire production process, from managing orders to cutting fabric. It allows brands and manufacturers to work faster, smarter and more sustainably while fostering better collaboration.

| Valia Fashion – The game-changer

When orders come in, Valia Fashion takes care of the whole cutting process automatically. It makes sure the right materials, tools and factory settings are used for each order based on things like location, equipment and environmental conditions. It’s powered by AI, IoT, big data and cloud computing—everything you need for a true Industry 4.0 solution. Valia Fashion helps improve fabric use, machine productivity, sustainability and even cuts down on electricity usage. Plus, it works with a variety of cutters, including Lectra, Gerber and any other cutter brand, making it super flexible. |

AR: You called Valia Fashion one of the biggest tech breakthroughs. What’s got you so pumped about it and why do you think it’s a game-changer for the industry?

Daniel: Valia Fashion is a gamechanger that’s been years in the making. We’ve put in seven years of research and development and invested € 25 million to create a solution that’s set to transform the industry. Valia makes everything in the manufacturing process smarter and more efficient, from fabric to machines, by creating digital twins of fabrics, garments and even cutting equipment. This means we can simulate how materials and machines behave in real life and it all connects directly to our clients’ ERP systems.

When orders come in, Valia Fashion takes care of the whole cutting process automatically. It makes sure the right materials, tools and factory settings are used for each order based on things like location, equipment and environmental conditions. It’s powered by AI, IoT, big data and cloud computing—everything you need for a true Industry 4.0 solution. Valia Fashion helps improve fabric use, machine productivity, sustainability and even cuts down on electricity usage. It also works with a variety of cutters, including Lectra, Gerber and any other cutter brand, making it super flexible.

Valia Fashion also offers four key packages to meet different business needs: One is for brands that don’t manufacture but want to track their supply chain. The second is designed for subcontractors, while the third is for companies that handle both development and manufacturing. The fourth package is equipment based and gives insights into everything from factory productivity to fabric waste.

What makes Valia Fashion so revolutionary is its ability to adapt on the fly. If a problem pops up like a factory going down, it can automatically shift tasks to other factories or subcontractors that are ready to handle it. It even takes things like humidity into account, which can change how fabric behaves.

And with its automation, Valia Fashion can duplicate the decision making of top experts, so businesses don’t have to rely on individual knowledge anymore. This leads to better fabric usage and more efficient manufacturing processes.

One of the most exciting aspects is how well Valia Fashion integrates. It’s not just about tasks like pattern making or marker making anymore, Valia Fashion connects every part of the production chain, making it easy to manage everything, from subcontractors to customer systems to various tools. It even integrates with other systems like CLM, CRM and MES, which adds to its versatility.

The real kicker is how Valia Fashion communicates directly with our intelligent cutting machines, which have been using up to 400 sensors. These machines can read fabric behaviour and adjust in real time. For example, if fabric is supposed to be 1.8 metres but ends up being 1.78 metres, Valia Fashion immediately recalculates the cutting plan and adjusts the process, ensuring everything keeps moving smoothly. It’s a seamless back-and-forth between Valia Fashion and the machines, making sure things are always on track.

We’ve already launched Valia Fashion in France, Italy, Portugal and the US and we’re planning to expand to Asia in April. The feedback has been really positive, but as we move to the next level, connecting to different IT tools and systems will be more complex. The real test is whether customers just like it or decide to buy it, but we’re feeling confident. With no direct competitors for at least 5-10 years, Valia Fashion is ready to lead the future of fashion tech.

| India’s Move Towards Agile Fashion Production

I see India moving more towards agile production, with smaller, faster, made-to-order batches. The key to success is delivering quickly without holding large amounts of inventory. Many European brands already do this, changing products in production every few hours and they can only do that with an agile system and smart cutters that optimise the process. |

AR: Have you seen a shift in how the industry views technology over the years? Is it still considered an add-on or has it become something integral to stand out, innovate and compete?

Daniel: It varies based on geography and the company’s profile. It’s funny that our biggest customers in 2024 were European luxury brands that were struggling financially. These companies see technology as essential for transformation and adopting new business models.

The US is way behind Europe and Asia on fashion tech, even though they had a head start. But that’s changing now. With the new political climate, especially after Trump’s influence, businesses are feeling more optimistic and starting to invest in tech again, although they’re still a bit late to the game.

As for Asia, the situation is a bit different depending on the country. In places like India, Sri Lanka, Bangladesh, China and Japan, we saw fantastic growth in 2024. Many companies here understand that technology is crucial for staying competitive and pivoting their strategies.

In China, there is a growing focus on the domestic market rather than exports. Chinese companies will need to create high-value products to compete with European and American brands. It’s going to be a huge transformation, but some Chinese companies are still slow to catch on to this.

If I look back, when I last visited India more than a decade ago, I wasn’t sure if the market was ready for technology like ours. It felt like India was more focused on costs than on technology. But that has completely changed. Now, companies are seeing the value of investing in technology, not just for cost savings but for competitiveness.

Looking at the future, I think India has all the right ingredients to emerge as a global leader. With political stability, a tech-savvy workforce and entrepreneurial spirit, India is in a strong position. The US and China might neutralise each other in the coming years and Europe will likely fall behind. But I truly believe India is going to be a major winner in the global market.

| “The US and China might neutralise each other in the coming years and Europe will likely fall behind. But I truly believe India is going to be a major winner in the global market.” Daniel Harari CEO, Lectra |

AR: What’s the story behind your most prized possession-Gerber?

Daniel: You would be surprised to know that for 10 years, Gerber tried to acquire Lectra. In the 2000s, Gerber’s technology was good, but its strategy was fragmented, leading to significant losses. Eventually, the company went public in 1986, but by 2011, it had been delisted at a lower price than its IPO price. The company was later acquired by Vector Capital and then by AIP in 2016, which brought a strategic shift and stronger focus on customer service.

By April 2020, we found ourselves in a unique situation. Around 90 per cent of our customers were closed globally due to the pandemic and the board asked me how we would navigate the crisis. My analysis was that while the pandemic would impact short-term revenue, Lectra was in strong financial health and would come out of the crisis stronger than ever, given our recurring revenue model. This led me to decide that the time was right to acquire Gerber, which was also at a low point due to the pandemic.

We started discussions in August 2020 and finalised the acquisition in June 2021.

In the end, acquiring Gerber was the right move at the right time. We knew that the integration of its products and services with ours would make Lectra a much stronger company and allow us to lead the industry in innovation, technology and service.

AR: In our last chat back in 2021, you talked about the rise of on-demand production. Fast forward to today—how is Lectra, as a leader in this space, driving this transformation globally, especially in India where Just In Time production is becoming more prevalent?

Daniel: I was initially very convinced about Just In Time Production, but it didn’t take off as quickly as expected. In contrast, the furniture industry adapted very quickly, especially after Covid. Manufacturers realized that not holding inventory was an advantage—by producing made-to-order, they could get paid before the product was even made. Today, nearly half of furniture manufacturers are operating on a made-to-order basis.

In fashion, the transition has been slower. Many companies already have mass production systems and shifting to made-to-order would require overhauling their entire processes, which is costly and complicated. For those in the high-end or made-to-measure clothing business, like Chanel, the shift was easier as they were already accustomed to custom manufacturing, even without selling items in advance.

We are also partner of a large manufacturer based in Hong Kong with factories in Vietnam. It is a great example of successfully implementing made-to-order. It takes orders mainly from the US for custom shirts, which can be made in just 30 seconds. Its growth has been impressive and we’ve strengthened our partnership for the future.

The key to its success was optimising fabric usage. Initially, orders were processed one by one, but separating and mixing fabrics greatly improved efficiency. This method saved fabric and doubled profits. It’s scalable too, as we’re talking about over a million shirts and it’s something I believe could work in India.

Currently, fashion can be produced in three ways: mass production, agile production and made-to-order. I see India moving more towards agile production, with smaller, faster, made-to-order batches. The key to success is delivering quickly without holding large amounts of inventory. Many European brands already do this, changing products every few hours and they can only do that with an agile system and smart cutters that optimise the process.

There’s a shift from ‘push’ to ‘pull’ logic. In the past, companies would produce products and push them onto the market. Now, the focus is on pulling orders first, then producing what’s needed. This shift is a big opportunity for India, as Indian manufacturers are in a good position to adopt these agile, smaller lot production compared to countries like China and Bangladesh, which are still focused on mass production.

My advice to Indian manufacturers is to skip a generation of automation and focus on blending agile production with mass production. It’s similar to how countries without landlines leapfrogged to mobile phones. By focusing on smaller, quicker batches, Indian manufacturers can become more competitive globally without the risks of traditional mass production.

| Lectra’s Acquisition Strategy

“I strongly believe that a company like Lectra should grow through a combination of internal growth and strategic acquisitions.” Kubix Lab – Redefining PLM: “It’s a game-changer because it allows users to modify, enrich and synchronise data across different systems seamlessly. When we started discussions with Kubix founders, they had no customers, but by the end of the deal, they had four customers. Fast forward to today, Kubix has become one of the biggest successes of Lectra. We’ve gained a dominant position in PLM in Europe, particularly in the luxury fashion sector. In fact, we now win one out of every two PLM deals in Europe, with some customers from prestigious luxury brands having over 1,000 users.” Retviews – Elevating Marketing Insights: “At that point, we recognised that the value of a fashion company lies in three areas: creation, manufacturing and marketing. While we were strong in creation and manufacturing, we were weak in marketing. Acquiring Retviews allowed us to understand the marketing aspect better and cater to a broader range of customers.” Launchmetrics – Measuring Brand Impact: “Launchmetrics offers two key capabilities – the ‘launch’ of new brand campaigns and the ‘metric’ part, which measures the performance of these campaigns. Their database includes information on influencers, media and personalities, allowing fashion brands to track the impact of campaigns in real-time – the most important acquisition we made in the SaaS era!” Neteven – Strengthening E-commerce: “A SaaS platform that simplifies and automates the distribution of products across the world’s largest online marketplaces. This acquisition strengthened our position in digital marketing and e-commerce.” Gerber – The Strategic Masterstroke: “By uniting, Lectra and Gerber became the ultimate Industry 4.0 partner for their customers.”” |

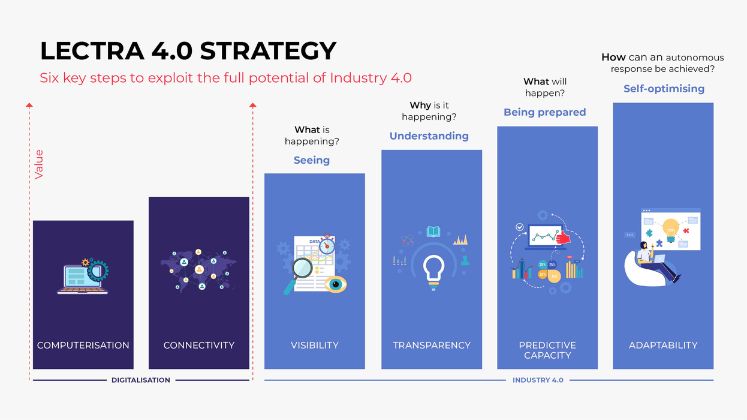

AR: Lectra outlines six key steps to fully exploit Industry 4.0—Computerisation, Connectivity, Visibility, Transparency, Predictive Capacity and Adaptability. Could you share specific examples of how these steps are integrated into your product offerings?

Daniel: Our approach to Industry 4.0 is deeply embedded in our product lineup, which is centred around powerful SaaS platforms designed to transform the industry in its core domains of action. Each platform reflects the six key steps of Industry 4.0.

As we have already discussed before, we’ve got Valia for manufacturing. We have just launched Valia for Fashion but Valia already existed for the furniture and automotive markets. Then there’s our newly acquired Launchmetrics for marketing, Kubix Link for collaboration and TextileGenesis for tracking and tracing. These platforms all work seamlessly together, sharing a common backend for data handling and cloud maintenance.

What’s unique is that we’ve purposely built different platforms instead of one giant system. Because a brand working with hundreds of suppliers can’t expect everyone to use the same tech. This flexible approach makes it easier for everyone to work together. Over the next few years, these platforms will replace our older tools, but we’re giving customers plenty of time and support to make the transition smooth. By 2026, we’ll be ready to deliver a whole new level of innovation to the industry.

And when it comes to embracing Industry 4.0, Sri Lanka is already leading the way in Asia. Their appetite for change and innovation is huge, with companies like MAS setting the pace. What’s interesting is that many Indian leaders are learning from Sri Lanka’s best practices and this could be the catalyst for driving change in India too.

AR: Given that many SMEs face cost constraints, does Lectra offer tailored solutions to make advanced technologies more accessible to them?

Daniel: To be straightforward, I don’t believe our technology is expensive at all. In fact, I’d say the return on investment is the best in the market.

Take the example of a cutter: Some of our competitors offer their cutters for around US $ 70K, while our cutter costs around US $ 150K. At first glance, it may seem like ours is more expensive, but our competitors’ US $ 70K cutter won’t do the same job as one of our US $ 150K cutters. To achieve the same output, you would often need three of their cutters, making their total cost closer to US $ 210K. So, when you compare the efficiency and output, one Lectra cutter is actually more cost-effective.

Now, for smaller companies that only need one cutter, we can’t downgrade our product to match that price point because our technology is too advanced and sophisticated. But for mid-sized companies that need two or three cutters, that’s where we become a much better choice. Once you compare throughput, efficiency and cost per garment, our system is more economical.

For growing companies, we often see them start with basic cutters from competitors because they’re more affordable at first. However, once they reach a certain size and realise the long-term savings, they come to us. After three to five years of using lower-cost equipment, they realise the value of upgrading to our technology, especially because it results in significantly lower production costs. Our cutters minimise fabric loss, reduce waste and cut down downtime, which is a huge advantage, particularly in high-demand environments.

In industries like automotive, we operate 24/7 with customers who have 98 per cent uptime, which is something very few pieces of equipment can achieve globally. This level of reliability is a key differentiator for us. Our service model also distinguishes us. Unlike competitors who rely on curative maintenance, fixing things after they break, we focus on predictive and preventive maintenance, ensuring the equipment is always running smoothly and avoiding costly downtime.

In India, we already hold around 67 per cent of the automated fabric cutting market when you combine Lectra and Gerber’s offerings. This strong market share shows that our customers value the long-term benefits of our systems. For mid-sized companies, we’ve made our pricing flexible. For example, our software like Valia, charges based on usage, so if you’re running one shift, you’ll pay less than if you’re running three shifts.

| Tackling Greenwashing

Greenwashing has been a big issue, especially when it comes to cotton. For example, brands often claim 1.5 kilograms of cotton per garment, but the reality is closer to 500 grams and a lot of that discrepancy comes from misleading claims. TextileGenesis solves this problem by offering a system where each kilogram of cotton is assigned a digital token that tracks its journey across the supply chain. This guarantees that what brands say is actually true and traceable. |

AR: How does Lectra’s solutions, especially TextileGenesis, combat sustainability challenges like greenwashing?

Daniel: TextileGenesis has been a game-changer for us. In late 2022, we acquired a 51 per cent stake in the company and it’s been a fantastic partnership. Amit Gautam, the Founder, has done an incredible job with his team, building a SaaS platform that helps fashion brands and sustainable textile manufacturers track the journey of their textiles— from fibre to consumer. It’s a digital solution that ensures full traceability, authenticity and transparency of every material used in production.

Greenwashing has been a big issue, especially when it comes to cotton. For example, brands often claim 1.5 kilograms of cotton per garment, but the reality is closer to 500 grams and a lot of that discrepancy comes from misleading claims. TextileGenesis solves this problem by offering a system where each kilogram of cotton is assigned a digital token that tracks its journey across the supply chain. This guarantees that what brands say is actually true and traceable.

The platform’s traceability system also allows us to track cotton’s journey around the world. For example, the cotton might start in the US, go to China for processing, then to Turkey for fabric production and finally end up in Europe before reaching stores. This visibility helps us reduce waste, improve efficiency and create a more sustainable supply chain.

Right now, we’ve tracked over 2 billion products through the platform. H&M is, for example, one of our big customers. What’s even more exciting is that we’ve now onboarded 95 per cent of the world’s cotton producers and this is exclusive to our platform. The digital token system ensures no one can falsify the data and third party certification bodies verify the authenticity of the materials used.

The platform also offers transparency into the reputation of subcontractors. If a subcontractor is involved in unethical practices such as child labour or pollution, we can track it and that information becomes visible to brands. This ensures full accountability across the entire supply chain.

Today, over 6,000 companies, including 100 brands use our platform. What started as a small start-up has now become a key tool for global brands looking to ensure full traceability and avoid greenwashing.

When we first acquired TextileGenesis, their annual recurring revenue was US $ 1 million. By the end of 2023, it had tripled to US $ 3 million and we reached US $ 5 million by the end of 2024, with projections to exceed US $ 7 million in 2025.