Fashion brands and retailers are no longer relying on the success they achieve by merely selling clothes. The modern consumer demands a seamless, integrated lifestyle experience and fashion brands are responding by expanding their reach beyond traditional apparel.

Homeware, beauty, footwear and even experiential retail now form a part of the fashion ecosystem, as brands seek to create comprehensive lifestyle offerings that cater to evolving consumer habits.

From fast fashion giants such as Zara, H&M and Mango, to luxury powerhouses such as Chanel and Dior, companies are diversifying their portfolios to maximise brand value and customer loyalty. But what is driving this shift? And more importantly, what does it mean for the future of the industry?

Read on to discover

WHY ARE FASHION BRANDS DIVERSIFYING

1. Tapping into High-Growth Sectors

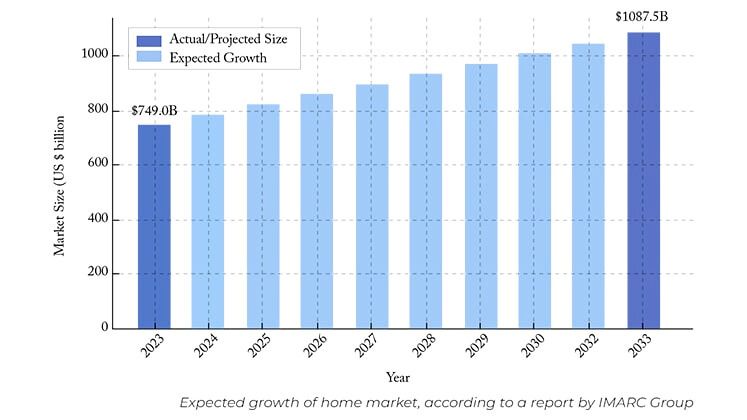

In the past decade alone, consumer lifestyles have undergone a massive transformation, particularly in the period post-pandemic. Homes are no longer just places to come back to and sleep — they have transformed into offices, entertainment hubs and sanctuaries of self-expression. This has fuelled growth of the home décor industry, which has surpassed US $

| The future of fashion is no longer confined to garments and accessories— it is about shaping the entire consumer experience. By expanding into home, beauty, experiential retail and even hospitality, fashion brands are creating holistic ecosystems that go beyond seasonal trends and foster deeper consumer connections. |

749 billion in 2023 and is expected to exceed US $ 1 trillion by 2032 (as per data shared by IMARC Group). Fashion brands are jumping to seize this opportunity, leveraging their design expertise and strong brand equity to enter the homeware market.

Similarly, the beauty industry has proven to be a lucrative sector for fashion brands with results flaunting the advantages. Luxury labels such as Chanel and Dior generate substantial revenue through their beauty and fragrance lines, with the beauty industry growing by 3-5 per cent in 2024 (as per data released by Bain & Co). Recognising this, mass-market brands like Zara and H&M have been quick to aggressively expand into cosmetics and personal care, further solidifying their position as lifestyle brands rather than just fashion retailers.

2. Adapting to Economic and Consumer Shifts

The fashion industry is experiencing shifting economic dynamics, with inflation and fluctuating consumer confidence influencing purchasing behaviour. This is directly impacting traditional apparel sales which are slowing down as customers prioritise quality, versatility and value-driven purchases. In response, this has given rise to sportswear and casual segments, while also pushing brands to explore alternative revenue streams beyond solely clothing.

By diversifying their product categories, brands can mitigate risks associated with declining apparel sales, ensuring sustained revenue via complementary product categories that align with customer interests.

3. The Rise of Cultural and Experiential Branding

Luxury fashion houses have long positioned themselves as cultural arbiters, transcending product categories to establish themselves as symbols of lifestyle aspiration. However, mass market brands are now following suit.

Take Inditex-owned Zara, for example. It has successfully diversified its offerings with Zara Home, Zara Beauty and now Zara Hair, reinforcing he idea of fashion as an allencompassing lifestyle experience.

| Long-Term Implications for the Fashion Industry

The transformation of fashion business models has significant implications for the industry’s future: 1. Fashion Will Become Even More Interdisciplinary The lines between fashion, home, beauty and experiences will continue to blur, giving rise to brands that operate as full-fledged lifestyle entities. Expect more collaborations between fashion and other industries, from hospitality and technology to wellness and interior design. 2. Retail Spaces Will Evolve Beyond Shopping Stores will shift from pure retail outlets to immersive brand experiences, incorporating cafés, beauty studios, home design consultation zones and even fitness spaces. The goal? – To keep customers engaged and loyal beyond a single transaction. 3. Sustainability Will Play a Bigger Role As brands diversify, sustainability will be a key differentiator. Consumers are increasingly drawn to shop with brands that align with ethical practices and businesses that integrate ecoconscious beauty, homeware and fashion solutions will have a competitive edge. 4. The Rise of Subscription and Personalisation Models With fashion brands entering new verticals, subscription services and AI-driven personalisation will become more prevalent. Expect customised home styling services, beauty box subscriptions and curated fashion-lifestyle bundles gaining more traction in future. |

Beyond products, Zara’s foray into experiential retail—such as Zacaffè, its in-store café concept— signals a new era where fashion brands focus on extending customer dwell time and enhancing emotional engagement. Arket, another Inditex brand, has also integrated lifestyle components like cafés and home essentials, reinforcing the interdisciplinary nature of modern fashion brands.

4. Democratisation of Lifestyle and Luxury

Historically, high-end homeware and beauty were reserved for the luxury clientele. But brands like H&M and Mango are challenging the notion by democratising these sectors, making designer aesthetics more accessible to a broader consumer base.

This is a strategic move – by offering affordable yet aspirational home and beauty collections, fashion brands are strengthening their relationships with consumers across multiple spending categories, ensuring long-term loyalty.

5. The Shift from Seasonal Fashion to Year-Round Engagement

Traditional fashion cycles and seasons are becoming less relevant in today’s fashion format as brands seek year-round consumer engagement. Diversified product categories allow brands to maintain a consistent presence in consumers’ lives, reducing reliance on the seasonal nature of apparel retail.

For instance, beauty products and home essentials have longer shelf lives compared to fast fashion, enabling brands to build more stable revenue streams while reducing dependency on markdowns and overproduction.