India, with its gargantuan population, has been the ideal market for any kind of service or brand because you’re likely to find an audience base large enough to beat the entire population of smaller countries. This is one of the primary reasons luxury has flourished in India. Not that Indians do not have the buying capacity or the inclination to indulge; luxury is fast catching up to serve the customers instead of holding on to age-long tactics that are suited to maybe just 1 per cent of the population, while the potential aspiration to be a luxury client can be found in all walks of life and all tiers of towns.

If we look at the factors contributing to the rise of luxurious fashion, it can clearly be attributed to changing consumer preferences owing to social media, brand awareness, higher disposable incomes, the disposition to buy more, and lastly, the ease of accessibility. It has been a fad for the purveyors of luxury goods to travel to metropolitan cities in the country to buy the latest fashion or expend while on international vacations. However, that changed quickly once e-commerce became the norm. And thanks to the pandemic, it is here to stay.

India’s fashion e-commerce market was expected to hit US $ 14 billion by 2020 as per The Economic Times, while the luxury goods segment valued at US $ 8 billion in India continues to grow at a CAGR of 6.6 per cent during 2019-2023. It is this promise that more brands want to buy into. The declaration of Reliance’s intentions to enter the online luxury business as well as Amazon’s interest in the area say something about the latent potential that waits to be tapped.

That being said, the game is not only meant for the giants; there are several smaller marketplaces and boutiques that are taking the luxury world by storm. The lockdown, a period that was testament to how well a brand can weather the adversities thrown at it, has certainly proved that luxury is an infallible investment as its clients are the least affected even during the fall of democracies. It is worth exploring the rise of these marketplaces, how they’ve been faring, what possibilities lie dormant and if luxury is a bankable segment even in difficult times.

Also Read: From road to ramp: Start-ups leading the streetwear movement in India

How has luxury gained from the e-commerce boom?

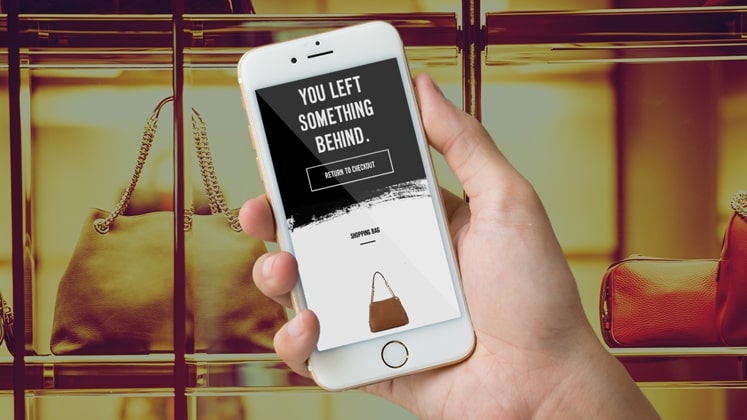

According to data collected by Forrester, the Indian luxury e-commerce market is expected to reach US $ 1.3 billion by 2023, growing at a CAGR of 29 per cent, one of the highest in the world, a comprehensively large figure catered to by players that can be counted on fingertips. As is pretty evident in recent times, purely physical retail is somewhat a thing of the past. It is the innovativeness with which a brand or an online store integrates technology whilst still taking care of their customer’s experience (unequivocally an important part of the luxury industry), that will determine who deserves a place in the market.

Darveys, an ingenious take on India’s luxury sector, is a marketplace with over 4 lakh subscribers that promises the world’s most exclusive brands at the best prices. Nakul Bajaj started the venture in 2014, partnering with luxury boutiques and vendors around the world offering luxury at a discount. From there, the products are made available to the Indian clientele with just the addition of the taxes and duties. Darveys prides itself in being a tech company rather than a fashion one because its algorithms give customers unbeatable prices that are almost impossible to find on the likes of TataCliq or DLF Emporio.

Talking about the growth of e-commerce and the impact of the pandemic, Nakul averred, “The pandemic played a great role in helping people explore a platform like us instead of having to pay full price. Pre-pandemic to now, we’ve grown four times because people aren’t travelling. Earlier, even if people travelled, they wouldn’t know the particular store in a country where they could get a product at 40 per cent discount.”

“We have afforded them the opportunity to take advantage of say a Thanksgiving sale or a Black Friday sale in the US or Europe while sitting in India. So while every company is telling people to leave, we’ve doubled our team in the last 2 months because there’s way more demand than we anticipated,” he added.

Post establishing that there is a large consumer base for luxury, it is important to note that the demand is coming not only from metropolitans, even Tier-2 and Tier-3 cities are responding to luxury with growing awareness brought on by the internet and their growing standards of living.

As Smita Jain, Director of Master in Global Luxury Goods & Services Management (MGLuxM), SP Jain School of Global Management, put it, “For a vast country like India with a lot of population in Tier-2 and Tier-3 cities, there is potential. The brand needs to know early on that they have to be creative while addressing the needs of this consumers. From local boutique formats to now social media selling which a lot of emerging designers are adopting, designerwear has evolved tremendously in India. Compared to before, today designerwear with respect to retail has various options to reach its end consumer.”

Also Read: Clothing the Curvy: Start-ups devising a successful plus size strategy

Is luxury immune to market changes?

Luxury consumers, often High Net Worth Individuals (HNIs), are one of the least affected classes of society when it comes to economic depression, demonetisation or a pandemic for that matter, rendering the market more stability than other branches of retail. Although there were signs of downturn for the luxury market with famous retailers like Brooks Brothers and Neiman Marcus declaring bankruptcy, overall luxury may have suffered, but that hardly puts much of a dent in business because the margins are so high. In fact, both the brands quickly found investors bringing an end to their financial woes.

Of course, luxury at the end of the day isn’t immune to market changes, but it bodes well for the segment when pent up demand leads to the likes of Hermes selling US $ 2.7 million worth of merchandise within 24 hours of re-opening its store in China after months of lockdown. Also, Capri Holdings, which owns Michael Kors, Versace and Jimmy Choo, saw an 11.9 per cent increase in Q1 while Bottega Veneta posted a 10 per cent increase.

So, is this perspicuous display of luxury’s growth and likelihood to withstand market changes the reason big brands are betting on both e-commerce and luxury? Well, yes. Even internationally, Alibaba’s Tmall has become the playground for brands to exclusively sell their products through standalone digital stores. “Since the consumer is spending more time than ever on the digital space and trying out different online shopping options, right now is the right time to introduce and experiment with a concept for designerwear like how Amazon and Alibaba have done with a plethora of consumer goods segments. But only if done well, this will work; it is important for the retail concept to be storytelling and thought-driven because that is what drives design… a story and the thought that goes behind creating the piece/or creations,” said Smita.

However, Nakul Bajaj has a completely contrasting outlook on the subject of conglomerates entering the luxury space. While welcoming healthy competition, he banks on exclusivity and the personal touch a brand like his can add to retailing in this segment that the magnates dabbling in various streams cannot.

How can brands set themselves apart?

The pandemic did give rise to pent-up demand during the months of lockdowns as many retailers of luxury agree. Despite having notified shoppers that delivery might be delayed for as long as 3 months, there was no dearth of orders on websites like Darveys that reported the same sales figures in April as March. Now that many international giants also want a piece of this undying fervour for luxury, the pertinent question is how smaller brands should remain relevant.

Vikram Gupta, the Founder and Managing Partner of IvyCap Ventures, has over 2 decades of experience that he has brought to top brands like BlueStone, Clovia and Purplle. When asked for his take on how smaller marketplaces should set themselves apart, he explained, “Brands can choose to either vertical-ise or go horizontal. The thing with vertical-isation is that you need to come out as a domain expert. Consumers should not only get the products and the quality, but also the experience they desire and that comes with understanding them. Personalisation is an area that needs to be built up with the help of AI that can give you a fair idea of who your customer is. If you establish yourself in a niche, the customer expects you to know everything they need.”

Channelling this very idea of understanding their consumers, Cecilia Morelli Parikh, Co-founder, Le Mill, launched her luxury e-commerce store during the pandemic to embody the customer experience present in Le Mill’s physical stores. “We wanted our consumers to feel joy when they browse through our website, the same way as one does in our store. In-store, we have personal stylists who help our clients shop. We’re translating this personalised experience on our virtual platform through our blog and social media by curating edits tailor-made for our customers. So if a customer logs on to our website and feels lost, he/she can always take the help of our edits and style guides. We also have a live chat feature so shoppers can connect with our stylists in real-time as they shop. We have a fantastic service called the Captain Service that offers personalised delivery and exchange services at your command,” Cecilia told in an interview to Grazia.

Le Mill is a tightly curated store that believes in maintaining personal relationships with clients and building a community. “Le Mill has been more than just clothes, and our blog and Instagram are a testament to this. We have built a digital community of women online who we engage with beyond fashion. Our blog, for instance, houses stories across fashion, design, art, food, culture, sustainability, and women who are mapping out the country’s future,” she added.

Does luxury’s future lie in sustainability?

The cost of being environmentally conscious always tends to be a tad expensive for the manufacturer or shopper. The fact that consumers are ready to shell extra few bucks to go green, makes them fall in the same category as luxury shoppers who pay for the experience and the quality to some extent.

Luxury brands have traditionally never been sustainable. They use premium leathers and elude transparency talks hiding under the guise of trade secrets. However, the rise of the conscious consumer at mass levels has pushed the envelope when it comes to incorporating levels of compliance in the supply chain for luxury too. Sustainability has taken on the connotation of not only limiting itself to lesser wastage of fabrics, responsible production of fibres or consumption of less water; it also translates to worker safety, being free of animal cruelty and overall social justice.

Recognising a gap in the market for a one-stop-shop of sustainable, fair-trade and animal cruelty-free contemporary fashion, Saachi Bahl started Saahra. The luxury stockist retails through its physical store in Delhi as well as its official website, carefully chosen aesthetically modern, classic and minimalistic sustainable brands. “We aspire to take great pride in being reliable, responsible and ethical in our practices. Therefore, a great deal of time, effort and research has gone into filtering the collaborators we work with on various levels, such as their design philosophy, manufacturing methodology, supply chains, quality control, labour working conditions, etc, to ensure they align with the globally recognised parameters of being labelled sustainable and fair-trade,” Saachi asserted to Vogue India.

Stepping into the realms of sustainability might not be a requisite only due to rising environmental concerns but might soon become a necessity for attracting investment too. Vikram Gupta emphatically stated that there are certain parameters his venture capital fund might look for in the future before investing. “While investing, we look at the passion in the entrepreneur to build a differentiated story that is unique, sustainable and scalable. Our selection ratios are very small; therefore, we can make conscious filtration criteria. The Sustainable Development Goals (SDG) that the United Nations has been promoting for the past year has 17 goals with specific targets enshrined under it. They talk on several parameters like gender equality, poverty, water, climate and also financial inclusion. You need to pick up goals that matter to your business and then be very passionate about improving yourself on those goals. That is something we feel we can create a culture of investing in itself. We have started talking to our existing companies also and many of them have started incorporating these,” affirmed Vikram.

Also Read: Building Nicobar: Seamless practices to create a successful brand