The UK and Australia are two very significant markets for Indian apparel exporters and it is high time for the companies to penetrate these markets, especially those which are not working in these markets or have less focus. Leading brands and retailers of both countries are performing well and are positive about their growth prospects. At the same time, Indian Government’s thrust on FTA with UK is construed to be instrumental in creating more opportunities. Indian apparel exporters, working with the leading companies of these markets, are also upbeat that both markets have a bright future.

Among the global uncertainties, there is hardly any strong sign for the recovery of the majority of leading economies but despite that, there is some positivity too. It is an election year for the UK market and experts are hopeful that the economy will perform better in such a year. Wage growth accelerated in the UK in May 2023 to around 5 per cent which is 3.8 per cent boost to people’s real income.

Revenue in the UK’s apparel market amounts to US $ 85.08 billion currently which is expected to grow annually by 3.46 per cent (CAGR 2023-2027). Women’s apparel, with a market volume of US $ 47.11 billion, is the largest segment. Around 94 per cent of sales in the apparel market is attributable to non-luxury goods.

Leading players in UK like NEXT, Primark and Marks & Spencer have a strong sourcing base in India and their business is doing well. Asos, JD Sports, TK Maxx, John Lewis, Sainsbury’s, Frasers Group and Boohoo are the other apparel companies in the UK having good performance.

Primark reported strong first-half sales, and in the UK, like-for-like sales climbed by 15 per cent as Primark attracted more shoppers on high streets and in retail parks as well as in its city centre stores which have become busy again as tourists and office workers have returned.

With around 500 stores, NEXT is considered a barometer of how British consumers are faring. It also raised profit forecast with wage hike and warm weather spurring sales. M&S group sales increased by 9.9 per cent to £ 11,988 million in FY ’23, primarily due to an 11.5 per cent rise in clothing and home sales, largely driven by a renewed focus on the modern mainstream customer. Both in-store and online sales showed considerable improvement.

India: a strong sourcing base for UK companies

Next Sourcing Services (India) is working with around 100 Indian companies and a few of the factories are having small-scale operations too as they have less than 100 workers. Similarly, there are many Tier-2 and Tier-3 suppliers such as trims suppliers, spinners and knitters. The company is optimistic about its business as it has raised its sales and profit guidance for the year, saying trading has exceeded expectations on the back of warmer weather and wage boost for consumers.

Primark is sourcing from almost 112 factories across India and industry insiders shared that it has recently shifted orders to India worth US $ 25-30 million. Working with Primark is also profitable as the brand is continuously expanding, recently entering the 16th market with the opening of a new store in Bratislava, Slovakia.

M&S also has a strong sourcing base in India as it is working with around 94 factories, out of which the majority are in apparel, while some are in homeware and footwear. The company recently forecasted a ‘modest’ growth in revenue in its new financial year after 2022-23 profit beat expectations. It also said that the company had made a good start in 2023-24 with growing clothing sales.

It is worth mentioning here that opportunities for small and medium-level companies are growing as Next and M&S work with companies that have worker strength under 100. There are factories, with less than 50 workers, working for M&S.

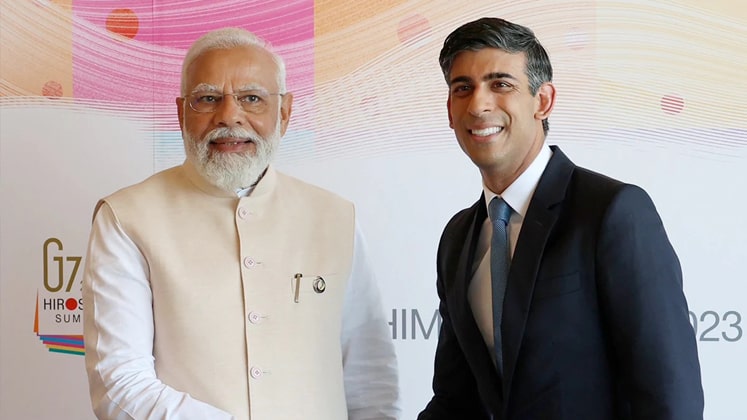

FTA with UK is going to be a massive support

As of now, India has the disadvantage of 9.6 per cent duty to UK but if India- UK FTA happens, there will be a great positive impact on the Indian apparel industry. And as FTAs are the Indian Government’s top priority, there are enough chances that this FTA will take place soon.

Leading Indian apparel companies are adding new clients in various markets. Gokaldas Exports recently added a new client from the UK market which is motivated by FTA. The company’s top management in a recent Earnings Conference Call said that the UK-based customers are actively talking and waiting for the FTA to happen and many of them are waiting to take advantage of the FTA as soon as it happens.

India’s PDS Ltd., is growing its operations in UK with its UK-based subsidiary Poetic Brands specialising in adults, kids and babywear licensed apparel and catering to multi-product ranges for Europe’s largest retailers. In FY 2021-22, it entered into a binding agreement to acquire a 100 per cent stake in Sunny Up Limited (‘Sunny Up’), which holds the exclusive European license for Stan Ray and other distribution rights. With this acquisition, Poetic Brands which currently operates with a Rs. 260 crore top line, will further expand its licensed portfolio.

Australia: Things are in India’s favour

Australia’s economy stagnated for some time but the good thing is that it has added 76,000 jobs in May as employers defied signs of slowing demand to expand the national workforce beyond 14 million for the first time. As per the Australian Bureau of Statistics, the jobless rate in May was 3.6 per cent, down from 3.7 per cent in April.

Though such signs are temporary and keep changing, but it will not be wrong to say that after signing India’s trade agreement with Australia, the Indian apparel trade to Australia can reach new heights.

India-Australia Economic Cooperation and Trade Agreement that was signed on 2nd April 2022 comes into force with effect from 29th December 2022. Now, Australia has zero import duty access to India’s textile products, which was earlier 5 per cent. Regarding sourcing from Australia, few of the companies are quite upbeat that their sourcing will surely increase from India. Few of the companies were working on growing sourcing volumes from India even before the FTA was formalised.

One of the most urbanised societies, the fashion industry in Australia in the financial year 2021 contributed around AU $ 27.2 billion (US $ 18.06 billion) to the national economy and is expected to show an annual growth rate (CAGR 2023-2027) of 11.54 per cent.

The exciting fashion retail sector of Australia boasts of around 16,306 clothing retailing businesses (as of 2023), registering an increase of 7.8 per cent from 2022 even as records suggest Australians in general spent around AU $ 9.2 billion on women’s apparel in 2021, compared to AU $ 4.2 billion on men’s apparel. These markets are projected to develop at a CAGR of 3.27 per cent and 3.18 per cent respectively (between 2021-2026).

“We believe in the potential of India as a growing and stable economy and we will continue to further build our business in India. We are currently sourcing around US $ 200 million FOB across different product categories (soft goods, hard goods, apparel etc.,) and we are hoping to take it to US $ 400 million+ in the next 3-5 years,” says Arjun Puri, Director, KAS Group Asia. Kmart offers clothing for all categories including men, women, kids and babies across knits, woven etc.

It is worth mentioning here that few of the leaders in Australian retail have very nominal sourcing from India and now as things are favourable in India, Indian companies can turn this situation.

For example, Cotton On Group, one of the leading fashion companies has 81 per cent sourcing from China and 17 per cent from Bangladesh, while from India, it is just 1 per cent.

Similarly Country Road, one of Australia’s speciality fashion retailers with a market-leading position in the mid to upper tier of the segment, also highly depends on China, which contributes above 90 per cent of the group’s total sourcing value. Due to geopolitical issues, the group now wants to diversify its sourcing destinations for a smooth supply chain.

The Just Group, General Pants Co, Rebel Sport, David Jones are some of the other leading apparel companies of Australia.

The Australian market has an extremely competitive landscape but an important thing about Australia is that being in the Southern Hemisphere, it gives an advantage to the Indian apparel manufacturers to work for a different season compared to EU and other core markets. Rather than just following the traditional business model, suppliers need to approach the Australian business strategy and plan for long-term gains accruing from more balanced production cycles.

Most of the Australian mid-level brands and boutique buyers place orders almost throughout the year and the order size remains around 4000 pieces.

India’s Apparel Export to UK

| HS code | 2021-22 | 2022-23 | % growth or de-growth |

| 61 | 719.72 | 659.70 | -8.34 |

| 62 | 673.53 | 810.51 | 20.34 |

India’s Apparel Export to Australia

| HS code | 2021-22 | 2022-23 | % growth |

| 61 | 123.96 | 131.92 | 6.42 |

| 62 | 152.06 | 170.77 | 12.31 |

US $ million Source: Indian Government